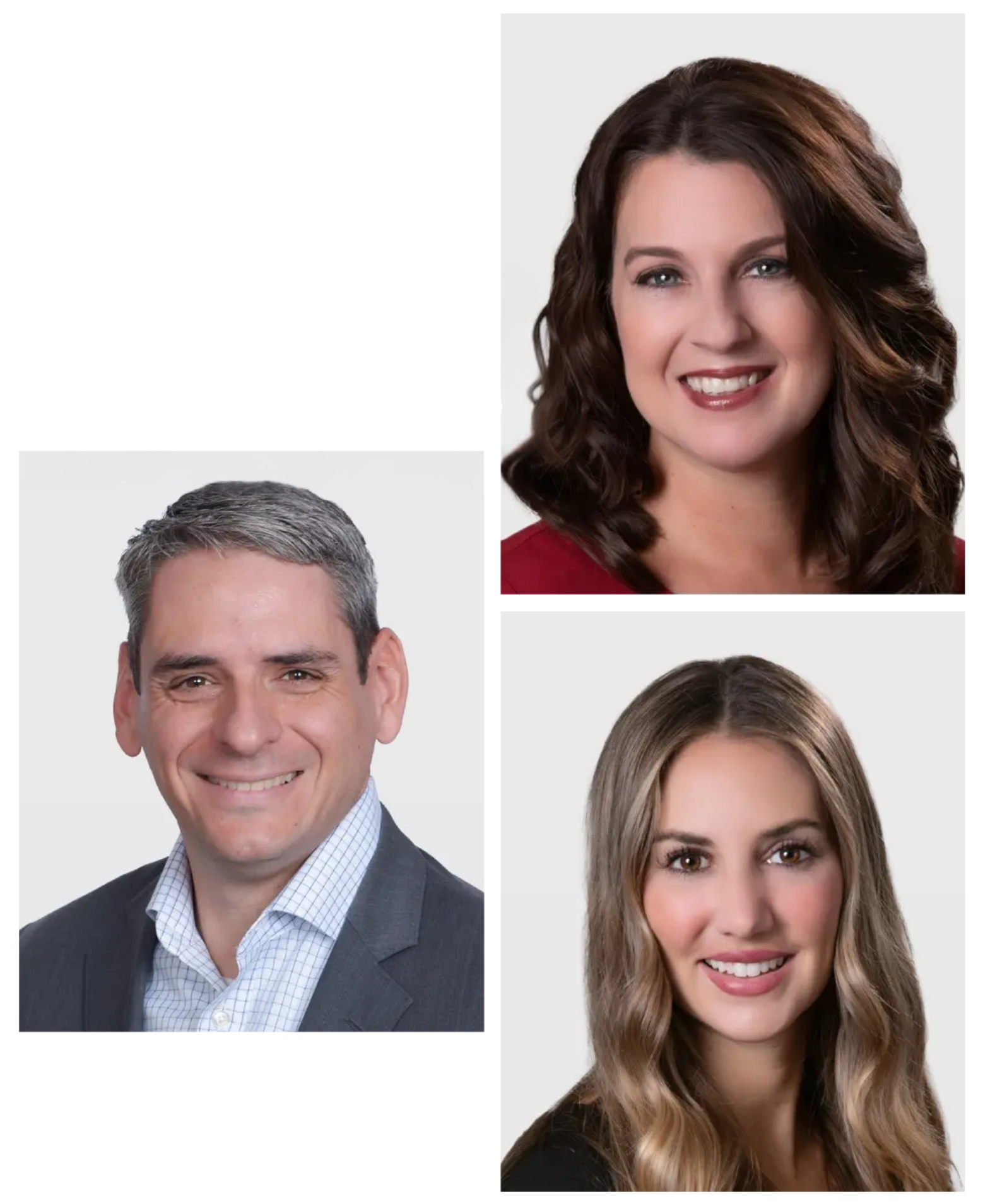

ANGELA LESSOR AND CHAD FAULKENBERRY

Financial Advisors and CFP® Professionals

Collaborative financial planning and advice for entrepreneurs and executives local to the Richmond, Charlotte, and Orlando areas and across the United States.

RICHMOND, VA

HOW WE HELP

Listening, Planning, Investing and Achieving Your Life Goals

Your life and financial goals are our guiding principles.

Doing the right thing is its own reward. We want to help you achieve your goals, using your unique and self-defined version of success.

TOGETHER WE WILL

- Collaboratively develop a financial plan that reflects and supports your goals, based upon a thorough understanding of what drives you.

- Guide your retirement funding and withdrawals, with a special focus on minimizing taxes and maximizing income.

- Serve as your business sounding board, whether you’re starting a new business, honing your operations or planning your exit.

- Ensure that your children, grandchildren and philanthropic vision are cared for and well-positioned for a rewarding future.

FINANCIAL

LIFE PLAN

We ask a lot of questions about where you are and where you want to be. Then we lay out a plan to get there and reassess it as often as needed.

INVESTMENT

EXPERTISE

Our comprehensive investment management strategies balance risk and reward, while staying aligned with your financial goals.

A PROVEN

TRACK RECORD

With over 50+ years of experience and certifications that include two CFPs and a CDFA, we’re well positioned to help you reach your potential.

ABOUT ANGELA

Financial Advisor

After taking a break from the corporate world for 7 years to be a stay-at-home mom, Angela began her career in financial services when she joined Mark’s team in 2007. She enjoys providing guidance to families to help ensure their overall financial success and well-being. Angela takes pride in cultivating strong client relationships through superior servicing.

As a wealth advisor, Angela believes in a holistic approach to financial planning. She is responsible for investment strategies and implementation. She understands that there is no cookie-cutter solution that applies to everyone. Each family needs recommendations that are specific to their personal needs and goals.

ABOUT CHAD

Financial Advisor, Managing Director

Chad began his career in wealth management his senior year of college at the University of Central Florida while obtaining his degree in finance. Originally intending to go to law school, Chad got an internship with Banc of America Investment Services that exposed him to the world of financial planning. As he went through this internship he knew that he had found his calling for his career and joined the team that he was interning with right out of college in 2004.

What Chad enjoys most about his role is the ability to connect in a meaningful and impactful way with the individuals and families that he serves. He has an ability to simplify the complexities that success can create and convey solutions in a way that is relatable to what his clients are looking to achieve. Chad gets great fulfillment out of helping his clients get the most out of their wealth and planning for what is important for them. You will find in working with Chad that while he takes what he does very seriously, he does not take himself too seriously.

When Chad is not working you will find him with his wife, Amy and three children Caitlin, Rachel and Luke. Active in the community, Chad is involved in his church where he sits on the finance committee as well as plays drums when needed. In addition to volunteering in the church, Chad is plugged in to the local arts community with Central Florida Community Arts volunteering in the youth orchestra as a percussion mentor as well as drumming in the group’s big band and for the community choir- the largest community choir in the country! Chad also is an avid golfer and tries to play as often as his full family calendar will allow.

Chad holds his CFP®, CPWA®, CLU® and CWS® designations.

RESOURCES

MEET THE TEAM

We Address the Entirety of Your Financial Life

We believe that financial goals and life goals are mutually supportive and that quality strategies are built on asking quality questions. We’ve built our reputation on digging deeply into who you are and what you want, so that you get the financial guidance that prioritizes what’s important to you as an individual, spouse, business leader and family member.

If you’re a business leader or aspiring executive, our team has the resources to help you achieve your goals. Whether you’re starting a business, fine-tuning your operations, planning your next move or ready for an exit, we specialize in managing the unique challenges and unlocking the tantalizing rewards of business ownership.

We’re here to help you create your ideal lifestyle and achieve success, on your terms.