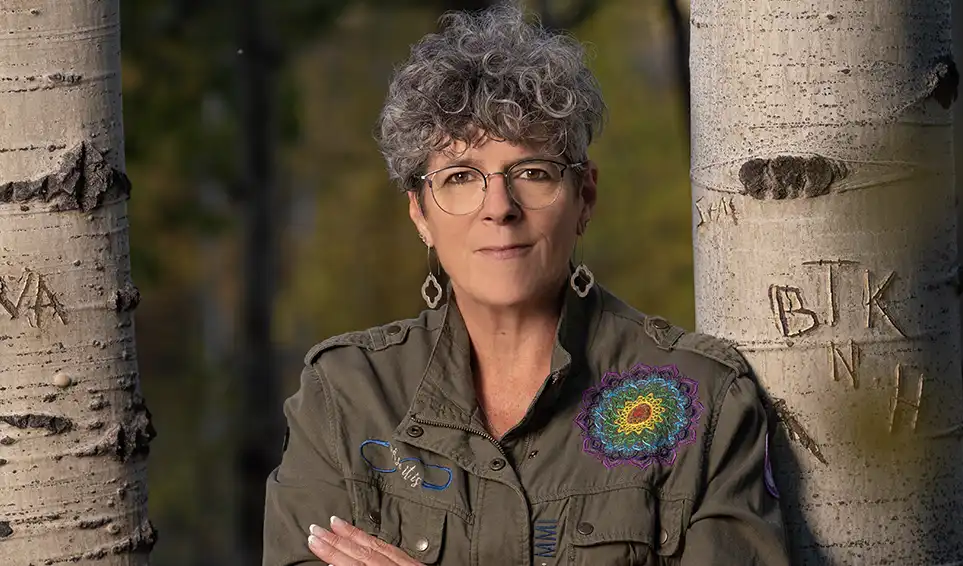

KATHLEEN BARLOW

Financial Advisor, Managing Director

Helping women nationwide build confidence and wellness through caring financial guidance.

NORTHWEST

HOW I HELP

Supportive Financial Guidance to Help Women Live Confident Lives

A holistic approach to finance helps you go where you want to go and be who you want to be.

Through this guidance, I empower women to feel more confident in their ability to make smart decisions with their money so they can live the life they choose.

TOGETHER WE WILL

- Explore your relationship with money, bringing clarity to the planning process.

- Envision what you want your life to look like now and in the future — and the path required to get you there.

- Uncover the resources and opportunities at your disposal so that you can take full advantage of what life has to offer.

- Set an intention for your financial life and beyond, and design a unique plan to help you work toward the goals you’ve set.

BIG-PICTURE PLANNING

I provide comprehensive financial planning services, considering every aspect of your financial life. From budgeting and investing to retirement and estate planning, my goal is to create a holistic strategy that aligns with your unique aspirations and values.

NAVIGATING LIFE’S CHALLENGES

Life is full of uncertainties. That’s why I’m here to guide you through its twists and turns, helping you make informed and thoughtful decisions even in the face of unexpected events, such as job loss, illness, or other significant life changes.

EMPOWERING YOU FOR FINANCIAL SUCCESS

Giving you the focus you need to overcome financial obstacles, seize financial opportunities, and build a secure future. By sharing stories, providing education, and offering personalized guidance, I aim to create a supportive community where women can thrive financially and achieve their goals.

ABOUT KATHLEEN

Financial Advisor, Managing Director

Kathleen grew up in a family of six, where she first learned the importance of order and planning. She’s a devoted wife and mother, with a son in his third year at college, two step children living in England, and a husband who shares her passion for adventure. Together, they enjoy spending winters in Cabo San Lucas, Mexico, and their summers exploring the Pacific Northwest in their airstream, with trips to Europe in between.

Prior to becoming a financial advisor, she worked in real estate. However, the 2008 recession—and the financial lessons it delivered—inspired her to make a change. As Kathleen built her advisory practice, she connected with women with stories similar to her own—tales of women conquering the world who then found the rug pulled out from beneath them.

Over time, her mission became clear: To help prepare women financially and emotionally to weather any personal crisis with a greater sense of confidence.

Financial Guidance That Goes Beyond Numbers

Taking control of your finances in the face of major life changes is incredibly empowering. Whether it’s the prospect of divorce, preparing for retirement, managing an inheritance, or anything else that means you need to focus on financial planning, I’m here to help you explore your relationship with money and unveil hidden opportunities.

Whether navigating life’s uncertainties, conquering financial obstacles, or seizing opportunities, I’m committed to creating a holistic strategy aligned with your unique aspirations. Together we’ll take a close look at your financial life, where we’ll set intentions, craft a unique plan, and work towards the goals that matter most to you.

Let’s get started.

Currently a client?

Schedule a meeting with me.

Not a client, but curious?

Let’s chat!

RESOURCES

MEET THE TEAM

Financial Guidance That Goes Beyond Numbers

Taking control of your finances in the face of major life changes is incredibly empowering. Whether it’s the prospect of divorce, preparing for retirement, managing an inheritance, or anything else that means you need to focus on financial planning, I’m here to help you explore your relationship with money and unveil hidden opportunities.

Whether navigating life’s uncertainties, conquering financial obstacles, or seizing opportunities, I’m committed to creating a holistic strategy aligned with your unique aspirations. Together we’ll take a close look at your financial life, where we’ll set intentions, craft a unique plan, and work towards the goals that matter most to you.

Let’s get started.

Client Experiences

Bev H.

Kay H.

Marty H.

Cheryl M.

These testimonials may not represent the experience of other customers and there is no guarantee of future performance of success.