The DOGE Dilemma: Navigating Economic Uncertainty and the Federal Deficit

The Deal with DOGE:

You can’t take a breath without hearing about DOGE. It’s either the worst thing that’s ever happened or it’s the best. DOGE is completely unconstitutional or those fighting it are enemies of our country. Those are weighty questions and well beyond my pay grade. However, there are potential economic effects (I say potential because, uh, read our own work, “Look Into The Future”).

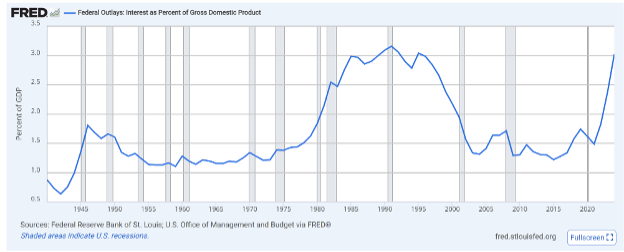

No, we cannot know what will happen this year or next. However, large-scale, relatively sudden unemployment has typically led to recessions. The consumer is a large driver of our economy (see the FRED chart, above). If hundreds of thousands of people are out of work, they are likely to spend less. Less spending means lower corporate profitability. Lower profitability means lower stock prices, and the spiral goes on, because lower profitability tends to lead to layoffs. In addition, the burden on unemployment benefits will fall on the States. This could create State tax increases or deficits on the State level (and more borrowing) or result in a diversion of funds from other State programs. The positive side is freeing funds at the Federal level. Will these dollars be used to reduce the deficit (I note that fewer people working means reduce income tax collections that would then reduce Federal revenue and reduce the value of less spending)? Will they be used for tax reduction? Who benefits from this? We do not yet know.

The Federal Deficit: Woe or Go?

So, let’s talk about the deficit. Many of you fear it. Logically, no one can borrow money forever, as the interest payments eventually crowd out other, necessary expenditures (many, many a bankruptcy was the result of too much borrowing).

How does this principle apply to our government? The Modern Monetary Theory (MMT – more on this here) folks will tell you that the Feds can simply print more money with no real consequence. What’s happened post-COVID, to me, disproves this.

However, what does interest cost and crowding look like as Gross Domestic Product (GDP) expands? If the interest cost, as a percentage of GDP, remains the same, you can argue the larger number has no additional impact on the function of Government or the US dollar. You can see above that, while the number is high right now, it’s not the highest it’s ever been. The unknown is are we going to control this, or will it rise?

Referring back to “Look Into The Future”, we do not and cannot know. Is it reasonable to be concerned about the deficit? I think so. Are we at financial end of times? I doubt it. Winston Churchill is often quoted as saying: “You can always count on Americans to do the right thing—after they have tried everything else” (discussion as to who actually said this can be found here). This sounds about right to me, regardless of who said it.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, a registered investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.