5 Tips for Last Minute Year-End IRA Contributions: Making the Most of Your Retirement Savings

As we approach the end of the year, many of my clients are thinking about how to maximize their retirement contributions. If you’re in the same boat and considering a last-minute IRA contribution, I’ve put together my best tips for helping you take advantage of this opportunity:

1. Know Your Deadlines

While we often think about IRA contributions as a year-end task, you actually have until Tax Day (April 15th, 2025) to make your 2024 contributions. This applies to both traditional and Roth IRAs. If you’re self-employed, you may have even more flexibility; you can file for an extension, which could give you additional time to make your contributions.

2. Keep It Simple with Documentation

One common misconception is that last-minute IRA contributions require extensive paperwork. The reality is much simpler: as long as your IRA account is already established, making a contribution is as straightforward as depositing funds into the account. Just be sure to clearly designate which tax year the contribution is for, especially if you’re contributing in early 2025 for the 2024 tax year.

3. Double-Check Your Contribution Limits

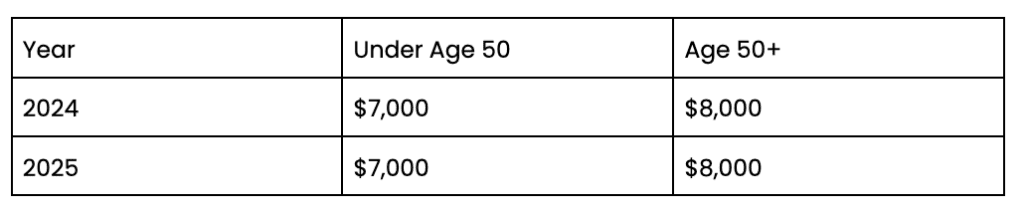

Perhaps the most common mistake I see with IRA contributions is not knowing the current limits. For 2024, make sure you’re aware of both the base contribution limits and any catch-up contributions you might be eligible for if you’re over 50.

IRA and Roth IRA Contribution Limits

Additionally, remember that your ability to deduct traditional IRA contributions might be limited if you or your spouse are covered by a workplace retirement plan.

4. Consider the Tax Planning Opportunities

Don’t overlook the tax advantages of your IRA contribution. Traditional IRA contributions offer an “above-the-line” deduction, meaning you can benefit from the tax break whether you itemize deductions or take the standard deduction. This can be particularly valuable for managing your taxable income and potentially qualifying for other income-based tax benefits.

5. Think Long-Term for Future Contributions

It’s certainly better to contribute late than not at all, but you’ll realize more benefits from a proactive approach to IRA contributions. Contributing earlier in the year gives your money more time to take advantage of potential market growth and compounding returns. Consider setting up automatic monthly contributions to avoid the last-minute rush and make saving for retirement a consistent habit.

Taking a More Proactive Approach to Your Financial Goals

If you find yourself consistently making last-minute contributions, it might be worth reviewing your overall financial planning strategy. Consider working with a financial advisor who can help you take a more structured approach to retirement saving and ensure you’re maximizing all available opportunities. If you’d like to learn more about how Journey works with you to develop a comprehensive financial strategy, get in touch here

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, a registered investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC, Headquartered at 80 State Street, Albany NY 12207. Purshe Kaplan Sterling Investments and Journey Strategic Wealth are not affiliated companies. Not FDIC Insured. Not Bank Guaranteed. May lose value including loss of principal. Not insured by any state or federal agency.