Tax-Efficient Wealth Transfer: The Family Trust & FLP Playbook

Affluent families, especially those operating business ventures together, face unique financial challenges and complexities — particularly when it comes time to transfer assets to the next generation.

While the estate tax exemption limit is high (up to $13,610,000 per individual in 2024), it’s still possible that a portion of your or your parent’s estate will exceed the limit and be subject to sizable tax liability upon death.

Two common tools for protecting and transferring family assets in a tax-efficient manner are family trusts and family limited partnerships.

What Is a Family Trust?

The purpose of a family trust is to ensure assets, real estate, and capital transfers to the next generation effectively and efficiently. When done right, trusts can also help families avoid probate after someone passes away, which is a process that can be expensive, public, and time-consuming.

Here’s how trusts work:

- The trust is established, the grantor (the person originally establishing the trust) transfers assets to the trust, meaning they are legally owned and retitled in the trust’s name.

- The grantor selects beneficiaries and determines when they will receive the assets — after they turn 18, once they get married, after they have their first child, etc.

Revocable vs. Irrevocable Trusts

What happens next depends on whether a revocable or irrevocable trust is established.

With a revocable trust, the grantor can make changes throughout their lifetime, such as changing what assets are held in the trust and who the beneficiaries are. While flexible, revocable trusts don’t typically provide the same tax benefits and level of protection as irrevocable trusts.

With an irrevocable trust, the assets become legally separated from the grantor. In terms of taxes, this can be beneficial as anything put into the trust reduces the size of the grantor’s estate.

If you have a sizable estate and are concerned that it may exceed the federal or state exemption limits, a family trust is one way to reduce your estate’s potential tax liability. Considering federal estate taxes range from 18% to 40%, this can initiate some significant tax savings.

Considerations to Make Before Establishing a Family Trust

Keep in mind that establishing a family trust may not help you avoid taxes altogether. Income over $600 generated by the trust may be subject to income taxes. It’s also worth noting that trusts have their own tax brackets, which are different from normal taxpayer brackets. As a result, a trust’s income tax liability may be higher than if the assets were owned outright by the grantor.

In addition, revocable trusts, by nature, lack flexibility. It’s difficult to reverse decisions or make changes once assets are retitled and added to the trust.

And finally, cost and complexity are big factors to consider here. You’ll need to work with an estate planning attorney to establish a family trust, transfer assets, pay court fees, and compensate your trustee — all of which takes time and money.

What Is a Family Limited Partnership?

A family limited partnership (FLP) is created to hold a family’s business interests, real estate, securities, or other assets. It’s considered a holding company, which is owned by at least two family members.

An FLP has two types of owners: general partners (GP) and limited partners (LP):

- GPs are responsible for managing the FLP and the assets under it. In terms of a family, this is often the patriarch and/or matriarch of the family — the parents or grandparents who are generally in charge of the family and its business interests.

- LPs have an economic interest in the FLP, but they are not directly involved in managing or controlling assets. LPs are often the children or grandchildren of the GPs, and they typically have no say or influence over how the FLP is managed and operated.

In some cases, LPs may not even have the ability to sell their interest in the FLP. An LP can also be a trust (as opposed to an individual) — though typically these trusts are established with the children or grandchildren as future beneficiaries. As passive owners, LPs will still receive income (a percentage reflective of their ownership share) from what’s earned under the FLP.

Tax Benefits of FLPs

There are several tax benefits to having an FLP, specifically regarding estate and gift tax.

Say a piece of investment property is bought for $200,000 by your grandfather and transferred to the FLP. Ten years from now, your grandfather passes away and now the estate must be transferred to his heirs. Come to find out, that investment property has appreciated to $600,000. However because it was transferred to the FLP before this appreciation happened, it will only receive a $200,000 valuation as a part of the grandfather’s estate.

Cons of a FLP

FLPs also help affluent families maximize the annual gift tax exclusion. Parents or grandparents can put assets into the FLP, and then transfer LP interests in the FLP over time to their children or grandchildren. As long as the amount transferred is less than the annual gift tax exclusion, this is an effective way to transfer assets without triggering gift or estate tax liability.

If a creditor comes after a general partner for debts owed, the assets held in the FLP are at risk. However, the same is not true for limited partners. Their creditors cannot come after assets in the FLP.

Keep in mind that an FLP is a business, and it’s intended to manage business assets. Successfully navigating business operations and making forward-focused decisions isn’t for the faint of heart. Your family should have capable, knowledgeable, business-savvy people at the helm making those decisions before committing to an FLP.

This is especially important considering the time and money it takes to establish an FLP, which tends to be fairly complex by nature. You’ll want to speak with your financial advisor and an estate planning attorney before pursuing this type of structure. They may also advise you to speak with a property valuation expert, tax professional, or other relevant professional to ensure all considerations are made.

What’s Right for Your Family?

As someone who’s focused on building a lasting legacy for your family in the most tax-efficient manner available, trusts and FLPs can be important tools to utilize. If you’d like to learn more about transferring wealth to your next generation of leaders, contact our team today to learn more.

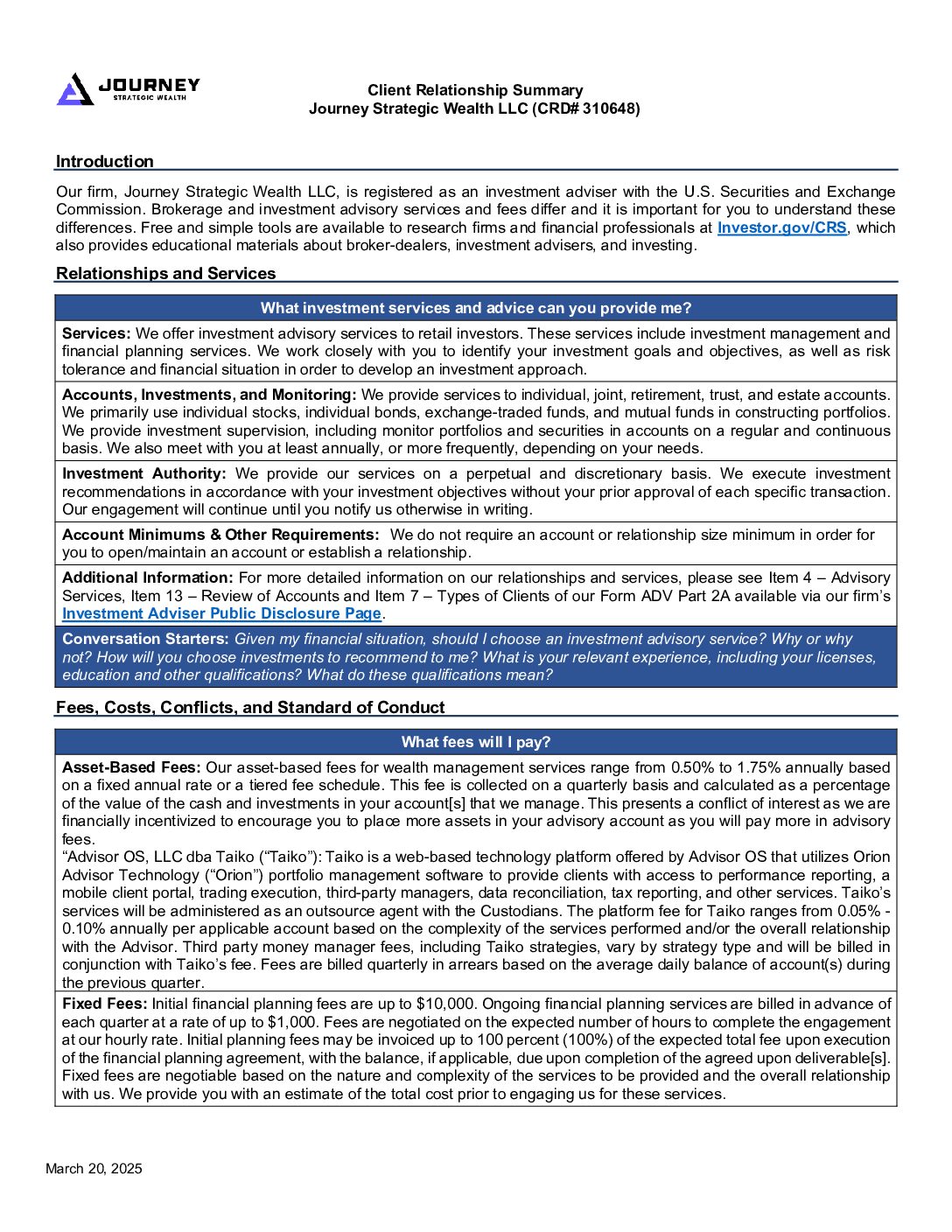

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.