Final IRS Regulations on Inherited IRAS: What Do They Mean for You?

Last month, the IRS released its new Final Regulations for Required Minimum Distributions (RMDs) for inherited IRAs, and it’s crucial to understand what they might mean for you and your family. Taking effect July 18, 2024, these rules bring significant shifts, especially for non-spouse beneficiaries. Here’s a breakdown of exactly what these changes mean for you and why you should care.

The Big Change: The 10-Year Rule

The SECURE Act, passed in 2019, changed the game for inherited IRAs by eliminating the “Stretch IRA” strategy, where RMDs could be stretched over your lifetime. However, with these changes, most non-spouse beneficiaries must now fully distribute the inherited IRA within 10 years of the original owner’s death.

First, it’s important to understand what category beneficiaries fall into. The SECURE Act breaks beneficiaries into three key groups, each with its own rules:

1. Eligible designated beneficiaries:

- The account owner’s spouse

- Disabled or chronically ill individuals

- Minor children of the deceased account owner

- Individuals who are not more than 10 years younger than the account owner

These beneficiaries can stretch distributions over their lifetime, giving them more control and potentially lower taxes.

2. Noneligible designated beneficiaries:

- All other individuals not in the eligible category

They face the 10-year rule, meaning they must empty the inherited IRA within 10 years of the owner’s death.

3. Nonperson beneficiaries:

- Entities like trusts, estates, or charities

These must follow the 5-year rule if the account owner died before their RMDs were due. Some trusts have different requirements, so check the specifics.

Two Groups, Two Sets of Rules

The exact rules depend on when the IRA in question was inherited, before or after the original owner had started taking RMDs.

1. IRAs inherited before RMD age: If the original owner had yet to start taking RMDs, beneficiaries can choose their distribution schedule within 10 years. That means taking out a little each year, waiting until the end, or anything in between. Flexibility is the name of the game.

2. IRAs inherited after RMD age: If the original owner was already taking RMDs, beneficiaries must continue taking annual RMDs based on the original owner’s schedule. This continues for the first nine years, but the entire account must still be emptied by the end of year 10.

Roth IRAs

The 10-year rule applies to both traditional and Roth IRAs; however, the rules for Roth IRAs are slightly nuanced. Since original Roth IRA owners don’t have to take RMDs, beneficiaries don’t either for the first nine years. However, the entire Roth IRA must still be distributed by the end of the tenth year.

No Penalties (For Now)

Because of the controversy over these changes, the IRS won’t penalize beneficiaries for not taking RMDs from 2021 to 2024. The mandatory annual RMDs start in 2025, giving beneficiaries some breathing room.

What Does This Mean In Terms of Tax Planning?

There are both benefits and drawbacks to be aware of when it comes to the new rules:

The Pros

Flexibility in distribution: Beneficiaries of IRAs whose original owners hadn’t started RMDs can decide when and how much to take out each year within the 10-year window. This allows for strategic tax planning.

Penalty relief: The IRS’s decision to not penalize missed RMDs for the years 2021 to 2024 provides relief and allows beneficiaries to catch up without financial penalties.

The Cons

Potential increased tax burden: The 10-year rule can mean higher taxes, as beneficiaries might have to take larger distributions over a shorter period, potentially pushing them into a higher tax bracket.

Loss of long-term growth: The end of the lifetime stretch option means beneficiaries lose the ability to extend the tax-deferred growth of the account over their lifetime and maximize its long-term potential.

What You Should Do

Planning your distributions is a key part of retirement planning, and the new rules make it even more important. If you anticipate taxes going up, consider taking distributions sooner rather than later. Spreading out withdrawals can help manage your tax bracket each year and possibly save money in the long run.

Given these changes, working with a financial advisor is more important than ever. Guidance from a professional makes it easier for you to navigate the new rules, optimize your tax strategy, and ensure you’re making the best decisions for your financial future.

Book a call with our team today to find out what the new regulations for RMDs mean for you, whether you’re the owner of an IRA looking to maximize your retirement savings, or a potential beneficiary.

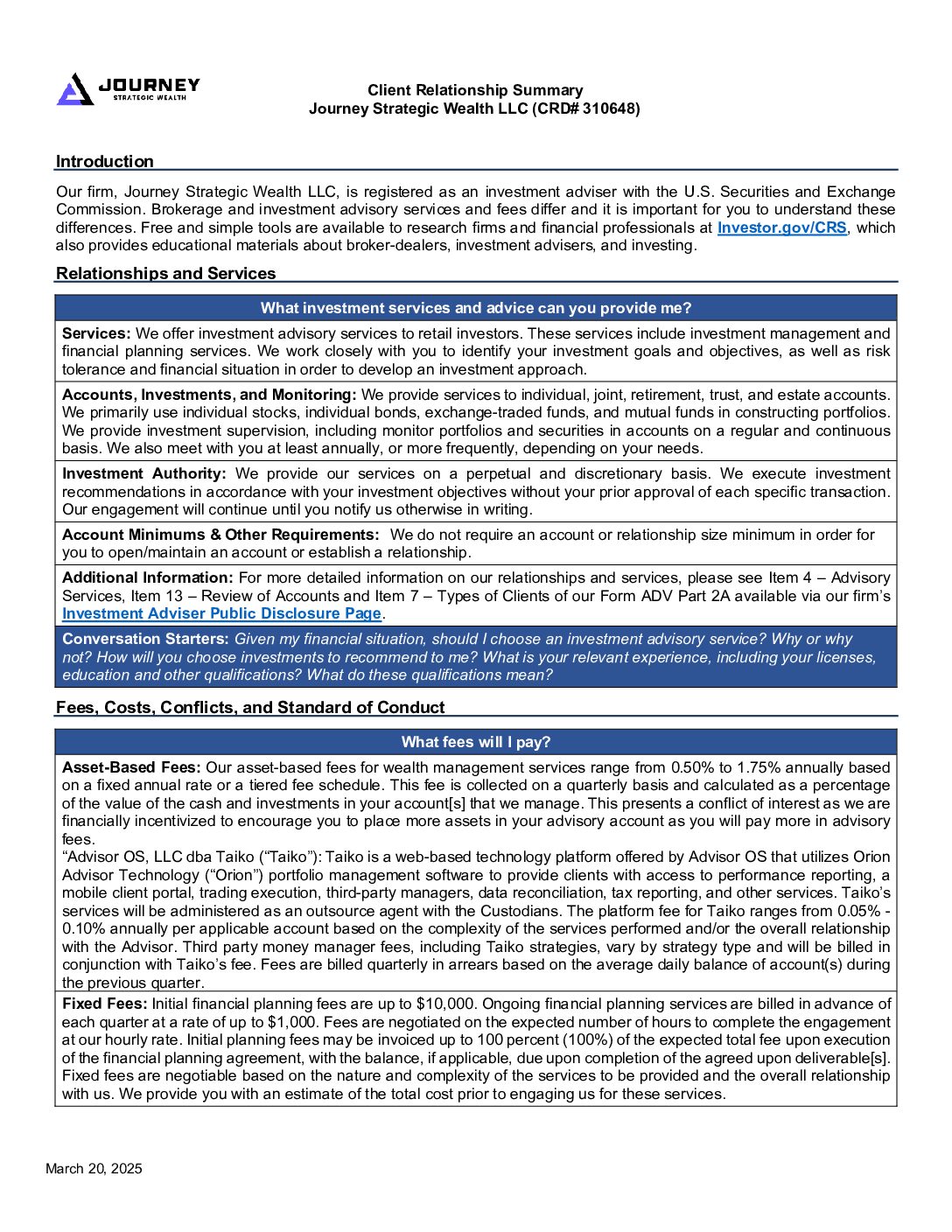

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.