Finding the Right Financial Advisor in New Jersey: What to Look for as a High Net Worth Investor

Being a high-net-worth individual (HNWI) brings a sense of financial security and opens doors to unique opportunities. However, managing significant wealth also comes with its own set of considerations. The financial landscape can be intricate, and the decisions you make have a large impact.

That’s why choosing the right financial advisor is more crucial than ever. Whether you’re seeking investment advice, estate planning support, or comprehensive wealth management, here’s how investors in New Jersey can make informed decisions in their search for the right financial advisor to safeguard and grow their wealth.

Do You Need a Financial Advisor?

Before beginning your search, it’s important to understand your financial needs, goals, and preferences. HNWIs are often in unique financial positions, ranging from sophisticated investment portfolios to complex estate planning requirements.

By taking the time to assess your financial goals, risk tolerance, and long-term objectives, you’ll be in a better position to narrow down your search and find an advisor who aligns with your specific needs.

Let’s get into what you should be looking for in your financial advisor:

Expertise & Credentials

These two factors are non-negotiable. You’re putting your financial future, and that of your family, in their hands, so you need to be confident that those hands are safe.

Look for financial advisors in New Jersey who not only have extensive local experience, but also have a proven track record in managing the wealth of HNWIs. Consider their experience in dealing with clients with similar financial profiles to yours, and their expertise in the areas that you’ll be looking for support in, such as investment management, tax planning, and estate planning.

Additionally, certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA) can provide reassurance of their professional competence and ethical standards.

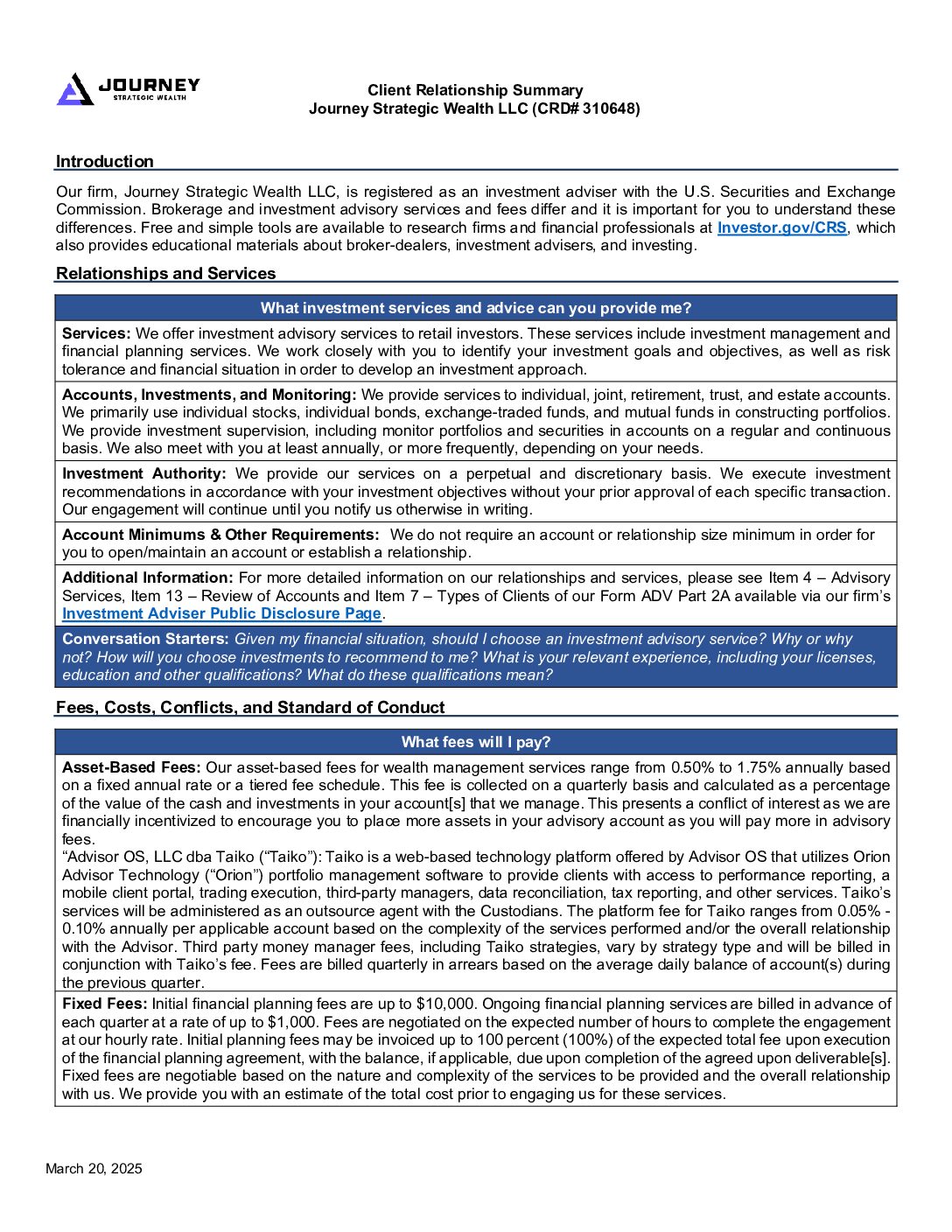

Fee Structure

The fee structure of a financial advisor can significantly impact your overall investment returns. As a HNWI, you may have access to a wide range of advisory services, each with its fee structure. Some advisors charge a percentage of assets under management (AUM), while others may opt for hourly rates or flat fees.

Take the time to understand the fee structure of each advisor you’re considering, and evaluate how it aligns with your investment strategy and budget. Remember, the cheapest option may not always be the best, especially when it comes to managing significant wealth.

Compatibility & Communication

Beyond expertise and fees, the relationship between you and your financial advisor is one built on trust, communication, and compatibility. Schedule meetings or consultations with potential advisors to assess their communication style, responsiveness, and ability to understand and address your concerns.

A good financial advisor should act as a trusted partner, providing personalized advice and guidance tailored to your unique financial situation. Trust your instincts and choose an advisor with whom you feel comfortable discussing your financial matters openly.

High-Net-Worth Financial Advice in New Jersey

From navigating state-specific tax laws to leveraging opportunities in the local real estate market, a financial advisor with a deep understanding of the local market dynamics can tailor their advice to maximize your financial outcomes in the Garden State.

Living costs here are a hefty 1.18 times higher than the national average, making wealth management a high-stakes game. And, while New Jersey doesn’t have its own estate tax, federal estate taxes still loom over estates exceeding $13.61 million.

But it’s not all hurdles; there are hidden treasures, too. New Jersey permits Dynasty Trusts and Generation-Skipping Trusts (GSTs), offering a tax-efficient pathway for HNWIs to secure a lasting legacy.

When looking for a financial advisor as a HNWI in New Jersey, make sure you choose one that’s fluent in its landscape. Look for experts who can deftly navigate tax laws, estate planning regulations, and real estate trends.

Remember that your financial well-being is too important to leave to chance. Take the time to research and interview potential advisors, ask the right questions, and trust your instincts. With the right advisor by your side, you can unlock the full potential of your wealth and enjoy peace of mind knowing that your financial future is in capable hands. Book a call to find out more.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.