2024 Tax Organizer Checklist for Self-Employed Business Owners

With April 15 fast approaching, now’s the time to gather up all those tax documents that have been accumulating on your desk and prepare to file. But as a self-employed individual, your circumstances are different from traditional W-2 employees, which can make things a bit more complicated come tax time.

To help you get organized and conquer tax season, I’ve created this quick and easy tax organizer checklist, which covers the most important aspects of preparing your taxes as a self-employed business owner. Let’s take a look at what documents you’ll need, how you can save a little extra cash, and what to think about for the year ahead.

Gather All Relevant Documents

Before heading to your accountant’s office, your first step should always be to gather up all relevant documents, emails, and digital files.

Here’s a list of documents to look for:

- All income-related tax forms received from other businesses or entities:

- 1099-K or 1099-NEC for contract work

- Your spouse’s W-2 or 1099s

- 1099-INT or 1099-DIV for interest or dividend statements, respectively

- Form 1095-A if you received healthcare coverage through your state’s marketplace (this is common for self-employed individuals)

- Last year’s tax return

- Your bank account’s direct deposit details (including account and routing numbers)

- Receipts or records of estimated tax payments made throughout 2023

Additionally, you may have received forms for certain expenses paid throughout the year, which you may be able to deduct from your income this year. Those expenses might include:

- Retirement contributions to tax-deferred accounts

- Local or state taxes paid

- Mortgage interest paid

- Property taxes paid

- Student loan debt repayment

- College tuition

- Childcare expenses

- Medical bills (especially if they were greater than 7.5% of your adjusted gross income)

- Charitable donation receipts

Prepare for Your Home Office Deduction

If you’re self-employed and work from home, you may be able to claim a home office deduction on your taxes. When the majority of the workforce went remote in 2020, the home office deduction became a buzzworthy topic of conversation—but it’s often misunderstood.

According to the IRS, you may be eligible to claim the home office deduction only if you use part of your home “exclusively and regularly for conducting business.” You may not claim the home office deduction if you work from home from your dining room table, for example, since that space is not exclusively used for business purposes.

However, if you’ve converted a garage or spare bedroom into your full-time office space, then you would likely be eligible.

Calculating Your Home Office Deduction

You have two options for calculating this deduction. You can either use the IRS’s simplified square footage calculation or base your deduction on the percentage of square footage your office takes up in your home. For the latter, if your home office is 100 square feet and your home is 1,000 square feet, the percentage would be 10%

Simplified square footage calculation: The IRS allows taxpayers to multiply the square footage of their home office space by $5 to determine their deduction rate. Again, if your office is 100 square feet, multiplied by $5 would give you a $500 deduction.

Business-use percentage: If you opt to use this method, you’ll deduct a percentage of your home’s operating costs. Eligible expenses include:

- Property taxes

- Mortgage interest or rent

- Utilities

- Homeowners Insurance

- Home maintenance and repairs

Say all of your monthly expenses (based on the list shared above) come out to $400 a month. Based on our earlier example, 10% of your whole home’s monthly expenses would be $40/month, or $480 a year in allowable deductions.

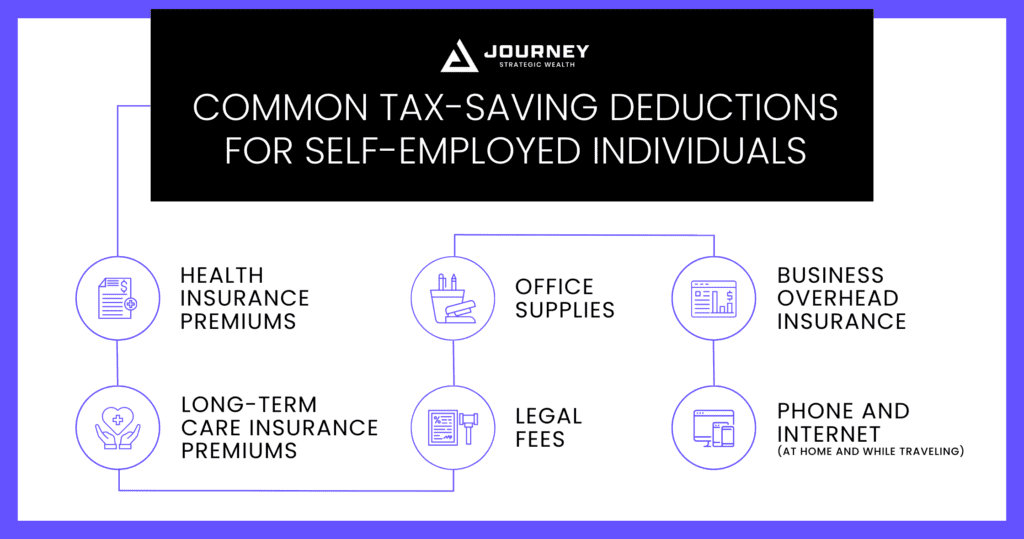

Find Other Tax-Saving Deductions for Self-Employed Individuals

I wanted to share a few common expenses that can actually be paid through your business and deducted from your tax returns. I’ve found that these particular business expenses often get overlooked by self-employed individuals. They include:

- Office supplies

- Legal fees

- Insurance premiums:

- Health insurance premiums

- Long-term care insurance premiums

- Business overhead insurance premiums

- Phone and internet (at home and while traveling)

- Meals with current clients, potential clients, or other professionals you’re discussing business with

- Child and/or dependent care

- Depreciation of your office or work equipment

What About Work-Related Travel?

The IRS allows self-employed individuals to deduct work-related travel expenses on their Schedule C Form. If you did combine personal and business travel into one trip (as many people do), just keep in mind that you can only deduct the expenses accrued during the work portions of your trip. If you had to travel to Los Angeles for a three-day work conference but stayed an extra four days to visit Disney, for example, you could deduct the hotel room costs for the three days you were attending a conference, but not for the additional four days of vacation time.

Understanding what travel-related deductions you’re able to claim can be complicated, and the rules change for domestic versus international travel. Just reach out to me to discuss possible work-travel deductions before filing your return this year if you have questions.

Don’t Forget, You Can Still Make Retirement Contributions

Self-employed individuals don’t typically have access to traditional retirement savings vehicles like 401(k)s or 403(b)s. You could, however, opt to open and contribute to a SEP IRA, Solo-401(k), SIMPLE IRA, profit-sharing plan, or other retirement savings plan. Even though the 2023 tax year is over, you might be able to still make 2023 contributions to your retirement account up until you file your tax return (including if you request a filing extension).

Each option comes with its benefits and considerations, including tax treatment, contribution limits, flexibility, reporting requirements, and more. If you’re currently contributing to a retirement savings plan, we can also review it together to see if it’s the best fit for you—or if there’s an opportunity to maximize your savings using a different method.

Thinking Ahead, What Should You Change for Next Year?

Once you can put 2023’s tax return in the rearview mirror, take some time to review your financial standings and assess if there are opportunities to save some tax dollars in the future.

One common tax-saving opportunity many of my clients take advantage of is giving generously to their favorite charitable organizations. There are many ways to be strategic in your charitable giving strategy, ensuring you maximize the impact of your gifts and achieve the tax-saving benefits. Think about what sort of impact you want to make over the coming year, in terms of how much you’d like to give, in what form (stocks, cash, property?), and to which organizations.

Need Help Conquering Tax Season?

Tax season is often a stressful time of year for self-employed people, but getting organized now should hopefully make it a less painful process. I work with many business owners, including self-employed people, to develop year-long tax savings strategies regarding their retirement contributions, charitable giving strategies, business deductions, and more.

If you need help navigating your taxes this year and preparing for what is ahead in 2025, don’t hesitate to reach out to our team.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.