Industry Spotlight: Social Security

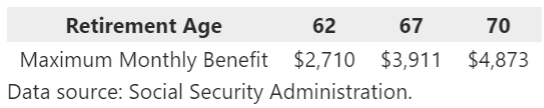

The maximum amount of Social Security, which you can see here, depends on the age at which you elect to receive the benefit and your taxed earnings (you maxed out for this benefit at $147,000 in 2023 and $168,600 in 2024). These amounts increase every year, based on the CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers). While it is rare that Social Security is the primary source of retirement income for most people, it certainly is, for most, a significant component.

First, if you are not familiar with the history of Social Security, look here. There were major changes in 1983 which put the System in good shape for over 50 years.

Most of the funding comes from FICA payroll taxes (Federal Insurance Contributions Act). While the Trust Fund estimates that its reserves will be depleted in 2035, roughly 83% of all benefits would be paid from FICA tax funding, although this would decline to 73% by 2098. This is from current projections and has been fairly consistent over the last few years.

Social Security is well established as an expectation/entitlement. Our policymakers and lawmakers have strong incentives to retain and fund the System. Current estimates show a 3.33% increase in the payroll tax would fund the entire 75-year shortfall (through 2098). Another alternative would be a 20.8% benefit reduction. This is not so much an achievability problem, financially, as it is a political problem (we want to spend, now, on other things and/or we don’t want to increase the payroll tax or cut benefits).

Might you be worried about your Social Security? Sure, and technically with good reason. The safest thing to do is assume a 17% or so reduction in benefits, starting in 2035.

For 2025, the Social Security benefits and Supplemental Security Income (SSI) payments will increase 2.5%. On average, Social Security retirement benefits will increase by about $50 per month starting in January. Over the last decade, the cost-of-living adjustment (COLA) increase has averaged about 2.6%. The COLA was 3.2% in 2024.

Could a political and therefore financial solution be found? It could, and our elected representatives are incented to do so. Our opinion is that a “no change” scenario is unlikely. We do not, however, have any way to know what our representatives will do. Our advice is save more than you think you need and work with your advisor to understand how much you might need if the System goes unchanged. Not too many people will complain if they “have too much money” in the future.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.