Open enrollment is your annual chance to review and adjust your employer-sponsored benefits. Many people rush through or skip it entirely, which can end up costing you.

Your benefits package probably represents a significant portion of your total compensation. Instead of thinking of open enrollment as a box to be checked, treat the selection process like the important financial decision it is.

Benefits Mistakes You Don’t Know You’re Making

- Defaulting to Last Year’s Elections

Roughly 90% of Americans choose the same health plan they had the previous year. While this may feel tempting because it’s convenient, it can be a big mistake.

Over the course of a year, a lot can happen: Premiums increase. Prescription coverage and deductibles change. Your doctor might move out of network.

And while last year’s plan might have been perfect for your life last year, you also need to consider any differences in your health, your medication, your household income, and your family situation.

Spending 15 minutes reviewing last year’s selection can save you thousands of dollars in the long run.

- Picking the Cheapest Premium Without Looking at Total Cost

Choosing a plan with a low monthly premium can feel like the smartest move until you actually need care and end up paying thousands out of pocket. One study discovered that more than half of employees in high deductible plans can’t cover their deductible when they need it.

Calculate your total annual cost: premiums plus deductible plus expected co-pays. That number matters more than the premium alone.

- Overlooking Tax-Advantaged Accounts

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) can help reduce your taxable income. HSAs can also function as investment vehicles with triple tax benefits: you contribute pre-tax dollars, the money grows tax-free, and you withdraw it tax-free for qualified medical expenses.

However, most people either don’t contribute to these accounts at all or contribute far too little, missing significant tax-efficient opportunities.

- Skipping Supplemental Benefits

Supplemental benefits, particularly disability and life insurance, often go unselected during open enrollment. But consider this: long-term disability insurance protects your income, which is likely your largest financial asset. If you can’t work for six months due to illness or injury, how do you pay your mortgage?

PPO, HMO, EPO, and HDHP Plans: Which is Right for You?

Choosing between the various health plan options can be confusing. Here’s a breakdown of what to know about each:

PPO (Preferred Provider Organization)

Best for: People who want flexibility, see specialists regularly, or travel frequently

What you need to know: You get the largest provider networks and don’t need referrals to see specialists. Out-of-network care is covered (though you’ll pay more). Premiums are typically highest.

With a PPO plan, you’re paying for flexibility. If you value being able to see any doctor you want, this could be a good choice.

HMO (Health Maintenance Organization)

Best for: People who want a coordinated, cost-effective plan

What you need to know: You choose a primary care physician (PCP), who manages your care and provides referrals to specialists. You don’t get out-of-network coverage except for emergencies. Expect lower premiums and lower out-of-pocket costs.

If you’re comfortable with coordinated care through your PCP, you may be interested in an HMO plan.

EPO (Exclusive Provider Organization)

Best for: People who want lower premiums but don’t want to deal with referrals

What you need to know: You don’t need referrals for specialists, but you won’t get coverage for out-of-network providers. Premiums fall between HMO and PPO levels.

EPOs balance cost and convenience, assuming your preferred doctors are in-network.

HDHP (High Deductible Health Plan) Paired With HSA

Best for: Healthy individuals, families who can budget for the deductible, and anyone wanting to maximize HSA contributions

What you need to know: Expect lower monthly premiums, higher deductibles and out-of-pocket maximums. You must meet federal requirements to qualify for HSA contributions.

The HSA component makes these plans particularly powerful. Your contributions reduce taxable income, so your money grows tax-free. Withdrawals for qualified medical expenses are also tax-free.

If you have predictable ongoing medical needs, the high deductible might cost you more than the premium savings. But for healthy individuals, HDHPs paired with HSAs work well.

Practical Guidance for Smart Decision-Making

Your benefits decisions should reflect your current circumstances, including:

- If you’re single and generally healthy: Consider an HDHP plus HSA for tax savings and lower premiums. Look for employer HSA contributions. Keep in mind that PPO flexibility probably costs more than it’s worth for you.

- If you have a family: Compare the family deductible across plans; sometimes, it can be double the individual deductible. Make sure your children’s pediatric providers are in-network, and evaluate dental and vision add-ons, which are often cost-effective for families.

- If you’re older or anticipate higher healthcare usage: PPO or lower-deductible HMO/EPO plans often make the most sense. Look closely at prescription tiers and specialty drug coverage. A lower out-of-pocket maximum might be more valuable than the cheapest premium.

- If you have a chronic condition: Review formularies carefully to confirm medication coverage. Look for disease management programs for diabetes, asthma, heart conditions, and similar issues. Plans with predictable co-pays offer more cost certainty.

- If you’re planning a major medical event: Surgery, pregnancy, fertility treatment. A lower-deductible plan might save thousands during high-usage years. Confirm hospital networks and specialist access beforehand.

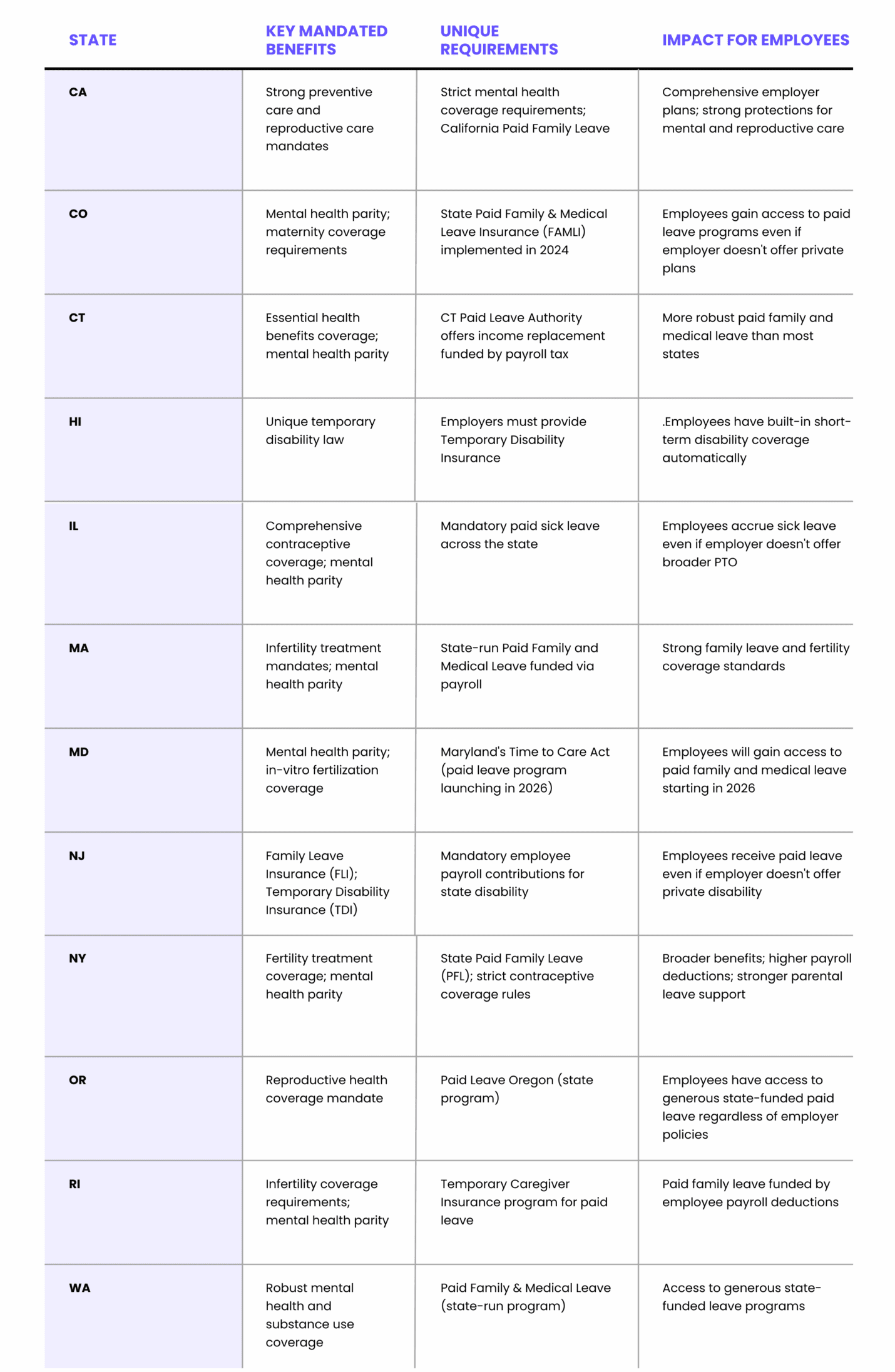

State Specific Considerations

Some states mandate specific benefits or offer paid family leave programs funded through payroll taxes, which affect both your coverage and your take-home pay.

If you live in one of these states, you may have access to additional benefits unavailable in other states. Make sure you understand what’s available to you.

Making the Right Benefits Choice for Your Specific Situation

The decisions you make during open enrollment affect your finances for the next 12 months. Review your options carefully. Calculate total costs, not just premiums. Consider your actual healthcare usage from the past year. Think about any major medical events you’re anticipating.

If you need help evaluating how your employer-sponsored benefits align with your overall financial goals, schedule a conversation with us. We’ll walk through your specific situation and help you make informed decisions.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, a registered investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.