Markets Steady After a Turbulent November

November ultimately played out like a roller coaster for global equities. After October’s highs, markets largely finished the month flat as investors grappled with shifting sentiment around whether the AI trade is truly in bubble territory. We have viewed much of that back and forth as noise given profitability and underlying cash flow health of the most prominent AI and AI adjacent companies. In this light, volatility, pullbacks, and even corrections are normal features of a healthy bull market given where we stand today.

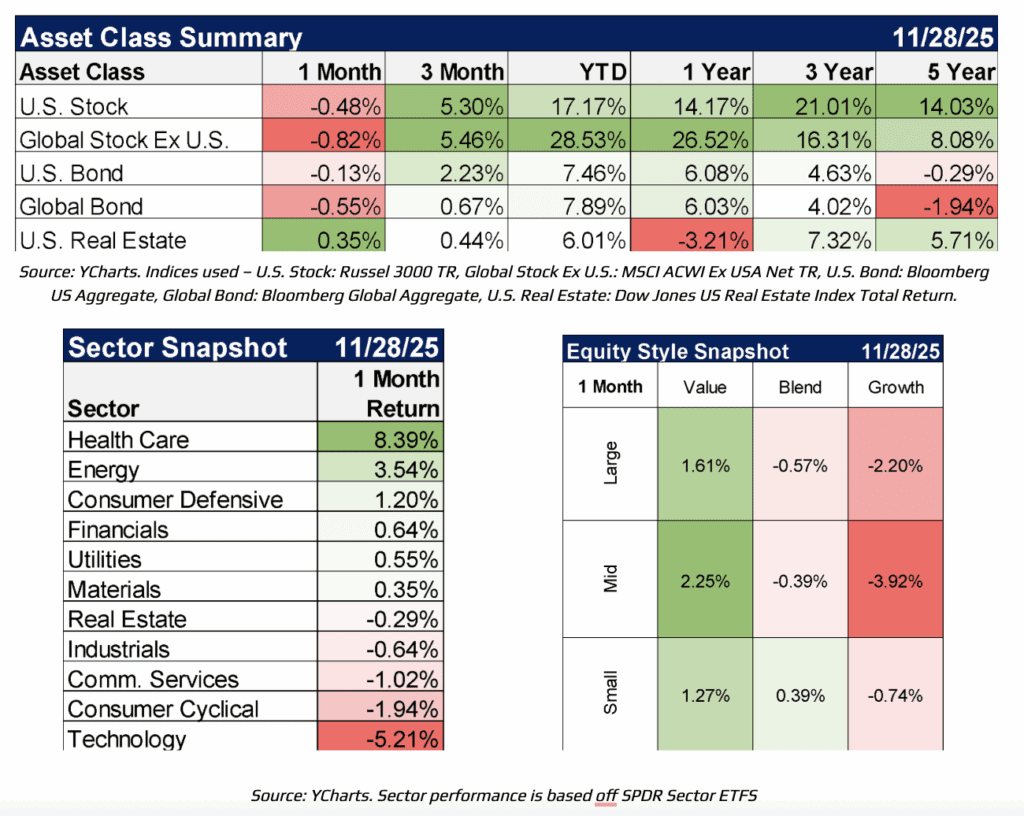

Over the past month, one noticeable trend was the widening gap between value and growth stocks. Value names generally outperformed U.S. growth equities, helping to stabilize markets against concentrated bets in artificial intelligence and technology. In the United States, equities rebounded during the holiday shortened week, with the S&P 500 rising nearly 4% and the Nasdaq climbing around 5% as the AI theme regained traction. This recovery erased most of the month’s losses, though the Nasdaq had been hit harder earlier in November amid pressure on AI-related stocks and bitcoin. Bitcoin itself staged a partial recovery in the final week of November but still finished the month down roughly 17%. Meanwhile, U.S. 10-year Treasury yields retreated toward 4.00% as markets once again factored in expectations for Federal Reserve rate cuts.

Key U.S. Data to Watch

Investors are looking to the U.S. ISM index for a fresh read on the struggling manufacturing sector. U.S. jobless claims also remain a focal point for understanding the labor market as markets wait for U.S. payrolls data to resume in mid-December. And because the University of Michigan consumer sentiment survey has been showing much weaker readings than other surveys, it may get more attention than usual, especially after the softer retail sales data we saw for September.

The Fed, the Labor Market, and a Complicated Data Backdrop

The Federal Reserve is widely expected to lower interest rates again next week, even as it continues to work through the economic data delayed by the government shutdown. This anticipated move aligns with clear evidence that the labor market has cooled, reflected in September’s payroll figures and recent jobless claims. Hiring has slowed, and many large companies now have better visibility into their cost structures heading into 2026, as seen in newly announced job cut plans. These trends give the Fed additional room to ease policy, supporting our positioning with an overweight to risk assets while maintaining factor diversification by balancing our natural growth tilt with value and quality exposures. The Fed has already delivered two rate cuts this year and has emphasized that weakening labor conditions remain central to its policy decisions. With uncertainty still elevated, policymakers have taken preemptive steps to avoid a deeper slide in employment.

The extended shutdown has added further complexity. As officials head into next week’s meeting, they are operating with an incomplete picture of economic conditions. Although we rely on alternative indicators to fill some of the gaps, these signals are still imperfect, even if they offer the best available read on labor market health. Both labor demand and labor supply have softened, with the drop in supply partly reflecting a sharp slowdown in migration. This shift has reduced the monthly payroll growth needed to keep the unemployment rate stable. It also helps explain why wage growth has remained relatively steady and why the unemployment rate has risen only slightly this year while remaining close to historically low levels.

Upcoming Data and What It Means for Fed Policy

The delayed data releases, including the October and November payroll figures due on December 16, though still missing the October unemployment rate, are likely to be volatile. October’s report will reflect deferred federal government layoffs, which could show a sharp drop in monthly employment, but the Fed would likely have already factored this into its earlier assessments. Importantly, all these figures will be released only after the Fed’s December 10 policy meeting.

Based on the data currently available, sentiment appears to have shifted significantly from earlier this year, when the central bank faced pressure to cut rates despite strong labor data, intensifying the tension between persistent inflation and long-term debt sustainability. Today, the Fed has a clearer path for easing without immediately reigniting concerns over those competing policy priorities, even as inflation remains well above the 2% target.

Keeping Perspective: Volatility Is the Price of Admission

It’s important to remember that, while equity markets have historically delivered long-term returns of 8 to 10%, the path from year to year is rarely smooth. Focusing on the long-term objective is far more important than reacting to short-term fluctuations, because volatility is simply the price of participation, and greater risk often brings the potential for higher returns.

Throughout this bull market, the MSCI World Total Return Index has experienced twelve pullbacks ranging from 2% to 10%. Each time, markets ultimately recovered and went on to reach new record highs.

When thinking about markets, it helps to maintain a long-term perspective and avoid overreacting to short-term movements. Volatility is normal and expected, and staying disciplined while focusing on your objectives is the most reliable path to achieving long-term investment goals.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.