Market Backdrop and Fed Dynamics

There’s been a broad-based rally in global equities this year, reinforcing the case for looking beyond the U.S. for diversification. At the same time, relatively muted tariff concerns, recently eased by new agreements with key U.S. trading partners, have alleviated fears of an outsized tariff-related drag on economic growth, further supporting higher valuations.

On the consumer front, core consumer prices, as measured by CPI, rose at a 3% annual rate in September, slightly below expectations. That softer reading initially increased the likelihood of additional Fed rate cuts in late October and December. However, Chair Powell’s more hawkish tone following the October meeting, where he noted that no additional cuts are guaranteed, quickly tempered those expectations. As a result, the 10-year Treasury yield reversed its post-cut decline, climbing back to where it started the month after the Fed delivered its much-anticipated 25-basis-point reduction on October 29.

Let’s unpack this. Inflation is procyclical, meaning it generally moves in line with the business cycle and broader economic growth, at least in simplified terms. As growth accelerates, inflation tends to rise; when growth slows, inflation tends to decelerate. Of course, the relationship is more nuanced, influenced by a range of variables, but this broad framework illustrates the dynamic at play.

When the Fed signals a willingness to cut rates, it aims to reduce borrowing costs and stimulate economic activity. Lower effective borrowing rates can encourage both business investment and consumer spending, which in turn fuels broader GDP growth. Conversely, if the Fed appears hesitant to cut, especially amid limited data availability caused by the government shutdown, investors may gravitate toward safe haven assets like Treasuries. That typically drives Treasury prices higher and yields lower. Yet, since the latest FOMC meeting, yields across the curve, from the 2-year to the 30-year, have actually risen. This suggests investors are demanding a higher term premium for holding longer-dated Treasuries, reflecting uncertainty around inflation and growth prospects in the near term, as well as the Fed’s mildly restrictive stance. It also signals that markets may be pricing in a slower pace of rate cuts ahead.

At present, markets are assigning roughly a 66% probability to another 25-basis-point cut at the December Fed meeting. Combined with the Fed’s recent October cut, this could help offset some of the tariff-related price pressures still impacting consumers. Importantly, the September CPI data remains reliable, as they were collected prior to the government shutdown.

“If You Build It, They Will Come” — Field of Dreams (1989)

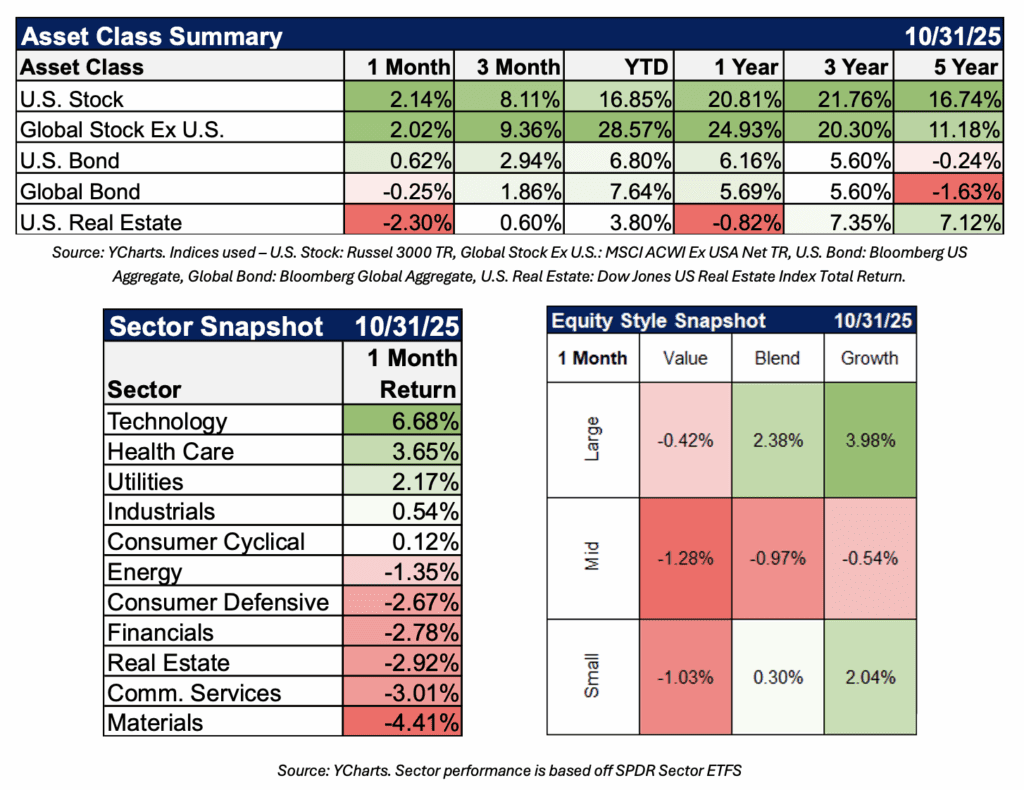

Nowhere is that sentiment clearer than in the tech sector, which provided a major boost to markets in October. Technology led all sectors for the month, contributing heavily to the continued outperformance of growth over value across all size classifications. While growth leadership isn’t driven solely by tech, it remains the clearest and most consistent factor.

The tech giants, Apple, Microsoft, Alphabet, Amazon, and Meta, all reported better-than-expected earnings last week. Most also indicated that capital expenditures will accelerate in 2026 as demand for computing power continues to outpace supply. Amazon’s cloud business, for instance, grew 20% year over year last quarter, excluding currency effects, its fastest growth since 2022.

At first glance, 20% growth might not sound extraordinary compared to smaller cloud competitors like Azure or Google Cloud, which are expanding at faster rates. But scale matters. By the law of large numbers, percentage growth becomes harder to sustain as a company grows larger. In absolute terms, Amazon’s projected cloud revenue growth for the quarter was roughly 50% higher in dollar terms than its closest competitor, Azure. That’s why we saw a 14% jump in AMZN shares in after-hours trading following the report: its highest-margin segment, cloud computing, is experiencing renewed momentum as demand for AI infrastructure expands.

All of this underscores a powerful trend: the demand for cloud computing services is both real and accelerating. Companies across industries are rapidly adopting tools for data storage, computing power, database management, networking, and AI-driven analytics, all essential layers of modern digital infrastructure. These capabilities allow businesses to analyze, automate, and innovate faster, creating a self-reinforcing loop of demand for more capacity and greater computational power.

Now, Amazon has signed a $38 billion multi-year deal with OpenAI to provide computing power using Amazon data centers to process ChatGPT queries, part of a broader data center expansion for the company. While this deal pales in comparison to past agreements made with the likes of Microsoft and Oracle, the rapid expansion underscores a key point: even the largest technology platforms in the world are struggling to keep up with the insatiable demand for compute. It may not fit perfectly with the Field of Dreams quote that inspired this section, but perhaps it’s more apt to amend it to: “Just build it, they’re already there.”

The Takeaway

The last month has shown how quickly markets can react to policy, economic data, and corporate earnings, yet the underlying trends remain clear. For investors, the lesson is simple. Short-term volatility is inevitable, but the forces driving long-term growth technology, digital infrastructure, and innovation are continuing to accelerate. The companies building capacity today are positioning themselves to meet that demand and understanding where growth is expanding can help identify the opportunities that matter most.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.