When tariffs dominate the news cycle, clients often ask: “How will this impact my portfolio?”

It’s a fair question, and an important one. As global trade tensions flare up, it’s essential to understand what tariffs are, how they work, and what investors can do to stay prepared.

What Are Tariffs, Really?

Tariffs are taxes placed on imported goods. Their objective is to make foreign products more expensive, which can drive more demand for domestic alternatives. While the intent may be to protect local industries, the ripple effects of tariffs are far-reaching, often affecting consumers and investors alike.

The Impact of Tariffs on Investors

- Inflation Pressure

When tariffs are applied, the cost of importing goods rises. Companies that rely on foreign-made materials often pass those costs on to consumers, which translates to higher prices at the checkout line. Over time, this can fuel inflation and reduce consumers’ purchasing power.

- Corporate Profit Squeeze

Many U.S. companies depend on global supply chains. Tariffs on raw materials like steel or semiconductors, for instance, can significantly increase production costs, leading to slimmer profit margins, higher prices, lower demand, and diminished earnings.

- Sector-Specific Disruption

Not all industries are impacted equally. Sectors like industrials, manufacturing, technology, and consumer electronics often feel the brunt of new tariffs. On the other hand, healthcare and utilities tend to be more insulated from these shifts.

- Market Volatility and Uncertainty

Even the threat of tariffs can cause markets to wobble. Headlines about new trade barriers often trigger investor anxiety and short-term pullbacks, even if fundamentals remain strong.

Our Approach: Proactive, Not Reactive

We can’t control trade policy or inflation, but we can manage risk through proactive planning. At Journey, we emphasize diversification to help soften the blow of unpredictable market forces like tariffs with strategies that include:

- Global Exposure: We’ve increased international investments, both in developed and emerging markets, to better balance portfolio risk.

- Interest Rate Sensitivity: To prepare for potential inflation or shifts in Fed policy, we’ve reduced the duration in bond portfolios, offering more flexibility should interest rates rise.

- Diversification in Practice: By spreading investments across asset classes, sectors, and geographies, we aim to reduce concentration risk and improve resilience.

Stay Invested. Stay the Course.

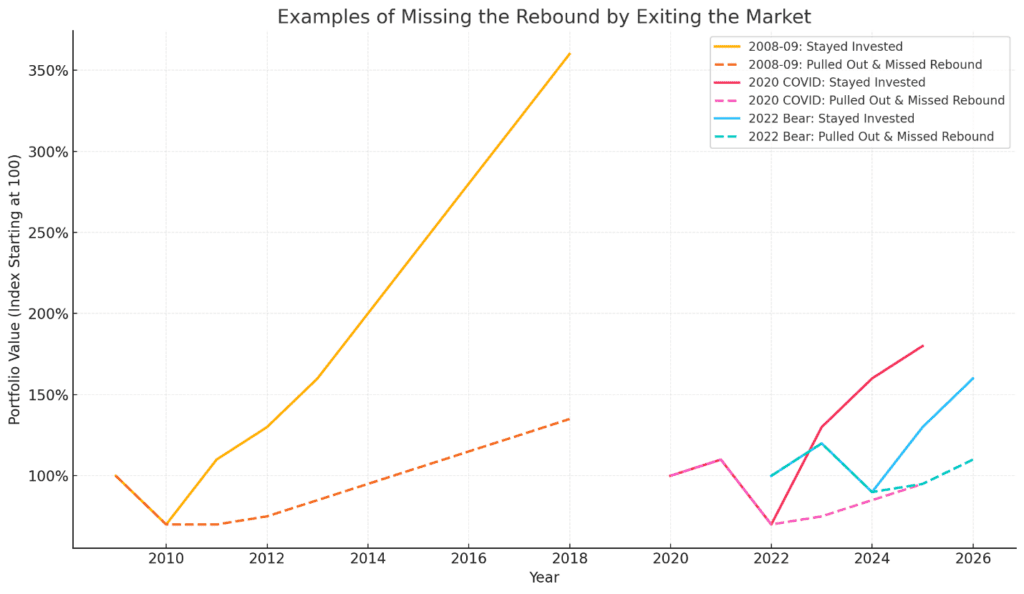

Tariffs can stir emotions, but long-term investing requires discipline, not panic. The data shows that some of the best market days often come right after the worst. Investors who exit during volatility risk missing those key rebounds, which can seriously hurt long-term returns.

Let’s look back at three recent examples:

- 2008 Financial Crisis

- 2020 COVID Market Crash

- 2022 Bear Market

In each case, those who stayed invested not only recovered losses but captured meaningful gains as markets rebounded.

Source: J.P. Morgan Asset Management. Guide to the Markets.

Maintain a Focus on What You Can Control

Economic headlines are designed to elicit strong reactions, and concerns about trade tariffs are understandable. But with a thoughtfully diversified strategy and commitment to a long-term approach, your financial plan can remain on solid footing.

If you’re feeling unsure about how current events might affect your portfolio, let’s talk. We’re here to help you navigate every turn on your financial journey with clarity, confidence, and perspective.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, a registered investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.