Failure to Launch?

The U.S., on average, has launched 10-20 orbital rockets per month throughout 2024 and 2025 to date. This is significantly ahead of the single-digit numbers we saw five years previously. Why is this important? I don’t know, it’s just to say that “what goes up must come down.”

Buffet Retirement

One of the greatest investors of all time, Warren Buffett, has focused much of his investment life on valuations. While valuations have come down quite a bit, the S&P 500 Index had dropped -19% from its peak ahead of and in the week following “Liberation Day,” but it’s essentially back to where it was on April 2. While many companies have found stable ground, the guidance from U.S. companies suggests that the real pain from tariffs is yet to be felt. U.S. investors, businesses, and households are worried about the impact of those policies, as illustrated in the significant weakness in investor, business, and consumer sentiment. The impact of the tariffs is likely not yet being felt in the hard economic data.

Again, the U.S. stock market has rebounded from what was a short-term oversold condition, however, we don’t expect it to rise smoothly over the coming weeks and months. Markets remain highly vulnerable to negative data and policy announcements and could still see some more pain. As we mentioned multiple times in the last commentary, this is a good time to speak with your advisor about your timeframe, tolerance for risk, and financial goals.

Safety First

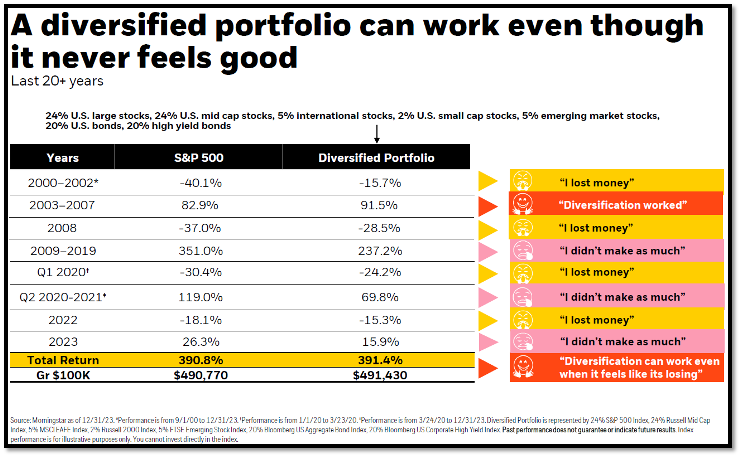

We took our equity levels down about 3% across the board in early May. We have been proponents for a global equity portfolio and that is certainly paying off. Many investors looking at a quilt chart might note that over the last 15 years (essentially back to the GFC), International stocks have outperformed U.S. Large Caps only three times and have an average annual return of a whopping 8% less. However, if you look at a quilt chart from 2009, International stocks outperformed U.S. stocks seven of nine years. Troubling at the time, during the financial crisis, a popular asset allocation would be some combination of REITs, Emerging Markets, and International stocks. Anyone care to take a guess which asset classes were hurt most by the GFC (a crisis driven by a Real Estate bubble)?

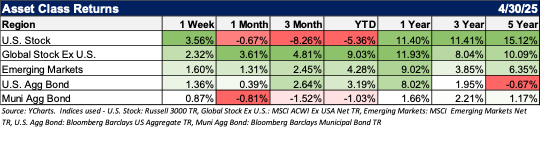

Most of our clients are not 100% invested in the stock markets, but all clients have benefited year-to-date by not being 100% U.S. Equities. There was a great infographic in BlackRock’s Student of the Market in early 2024. It’s not an apples-to-apples comparison, because we are comparing a 60/40 portfolio to an S&P 500 portfolio, but it is still useful for context (apologies for the color scheme):

The Diversified Portfolio is presented for illustrative and educational purposes only. Investors cannot invest directly in an index. Past performance is not indicative of future results.

I would also be remiss if we didn’t mention our push to do more alternative investments. We have presented solutions from household names like J.P. Morgan, KKR, Apollo, and more boutique names like USAA/Accordant or Pine Valley. Every single one of those solutions has provided positive returns for the first few months of 2025, when many investors have been anxious about the stock market.

Crystal Ball

At Journey, we tend to shy away from predictions. Those predictions tend not to age well. There has been a softer stance on tariffs from the current administration. It remains to be seen whether this will vault U.S. equities back to the top of the charts, but we remain steadfast that investors remain invested. There are opportunities for stock, bond, and private market investors. While we try to use the right tool for the right job, long-short direct indexing, active strategies in fixed income, equities and alternatives really show promise in this volatile environment.

While it could be argued that the investments team is boring and repetitive at Journey, I think we would argue that we are just consistent. We can’t repeat this enough: speak with your financial advisor about your tolerance for risk and how you can best structure your portfolio to weather the current storm. You really don’t want to remodel your house during a hurricane, but now that we have a little break in the volatility, it is a good time to have that conversation.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.