Why Planning Matters in Retirement: Finding Clarity and Confidence

Retirement should be a time of freedom and fulfillment—not a source of anxiety. After decades of working with clients, one question consistently arises—no matter how much they’ve saved: “Am I going to be okay?” Retirement can feel both exciting and daunting, because you’re moving from a lifetime of accumulation into a phase of distribution. This shift brings new priorities to the forefront—tax optimization, cash‑flow planning, Social Security timing, and crafting an income strategy designed to give you confidence for the long haul.

When your entire portfolio chases returns, your outlook can swing as wildly as the market itself—up one day (“I’m safe!”), down the next (“What am I going to do?”). That’s not the experience we find our clients have. They move from “will we be okay” to “we feel confident we are going to be okay.”

That’s exactly where our retirement‑planning process steps in—bringing structure to uncertainty and giving you both clarity and ease as you transition into this new phase. By systematically mapping your financial goals against the key risks you’ll face in retirement, we create a roadmap that feels as solid as it is flexible. Let’s dive into our M Guidance planning process.

Building a Plan That Addresses Your Goals and Risks

A resilient retirement plan does two things at once:

1. Determines Your Financial Goals

- Income Needs: What monthly income will cover your lifestyle?

- Contingency Expenses: How will you handle unexpected costs?

- Legacy Goals: What do you hope to leave behind?

2. Assesses Your Retirement Risks

- Longevity: Living well beyond your life expectancy

- Inflation: Rising costs eroding your purchasing power

- Health Care & Long‑Term Care: Medical and caregiving expenses

- Sequence‑of‑Return Risk: Withdrawals during market downturns

- Stock Market Risk: Short‑term volatility vs. long‑term growth

- Public‑Policy Risk: Shifts in Social Security, taxes, or regulation

By mapping your goals against these risks, we create a tailored strategy that helps prevent market swings from derailing your confidence—and your lifestyle.

________________________________________________________________________________________________

Establish Your Retirement “Paycheck”

Before anything else, we figure out in detail how much income you’ll need on a monthly basis to maintain your desired lifestyle and cover contingencies. Then we:

- Inventory Your Income Sources

Social Security, pensions, annuities, bond ladders—and any other guaranteed streams. - Identify & Fill the Gaps

If you haven’t yet built an optimal income base (your “floor”), we explore strategies—like annuity structures or bond‑ladder tweaks—to get you there.

Think of this as designing your retirement paycheck: once these core pieces are in place, your essentials are covered no matter how the markets move.

________________________________________________________________________________________________

Our Five‑Bucket Retirement Process

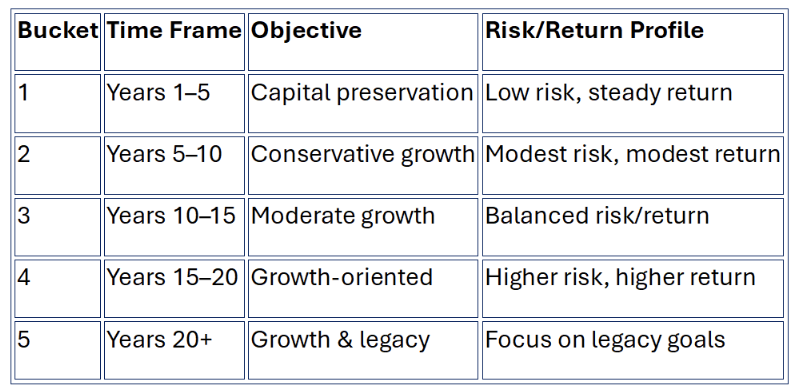

Once your income floor is secured, we divide the rest of your assets into time‑based “buckets,” each matched to an appropriate risk profile and intended time horizon:

This structured approach lets you spend confidently from Bucket 1, knowing your longer‑term needs are invested for growth.

________________________________________________________________________________________________

Tax‑Optimized Strategies & Legacy Planning

With your buckets in place, we layer on:

- Tax‑Efficient Distributions: Sequencing withdrawals across taxable, tax‑deferred, and tax‑free accounts.

- Roth Conversions: Taking advantage of lower‑income years or market pullbacks.

- Gifting & Estate Vehicles: Funding GRATs, CLATs, or direct gifts of appreciated stock to transfer wealth efficiently.

- Social Security optimization

- Goal‑and‑tradeoff analysis

- 401(k), annuity, and pension strategies

- Stock‑option planning

- Employee benefits and deferred‑compensation planning

- Long‑term care and insurance review

- Legacy and estate‑tax planning

________________________________________________________________________________________________

Ready for a More Confident Retirement?

Our firms’ mission has always been to help our clients thrive during retirement and not worry about their financial world. Market uncertainty doesn’t have to translate into personal uncertainty. With a clear plan that aligns your goals, mitigates your risks, and builds in both security and growth, you can approach—or enjoy—retirement with more ease.

If you’d like to explore how this process works for your unique situation, let’s connect.