Keeping Score and Own Goals

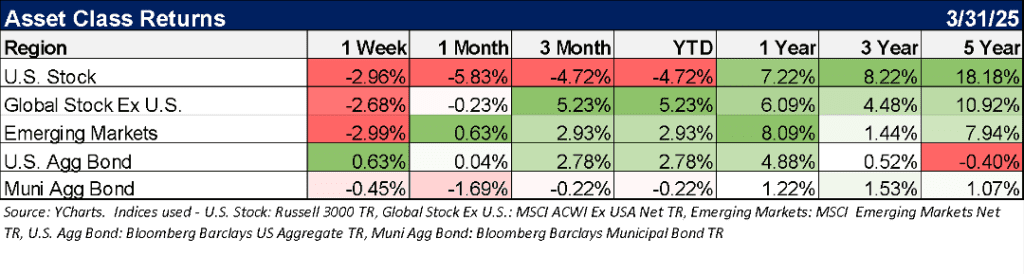

While the stock market has been a participation trophy over the last decade or so, right now, it is easy to see winners and losers. After U.S. large-cap stock dominance over international investments has been evident in 10 of the last 12 years, the first quarter of 2025 had a strong rebuttal that a Global Equity portfolio is the way to go. With roughly 1,000 basis points (or +10%) of outperformance in the first part of the year, the trailing returns have continued to tighten. I often remind people that while the post-Great Financial Crisis (GFC), U.S. equities dominated foreign developed markets, in the period from 2000-2009, U.S. Equities had a decade of lost returns and underperformed both International Developed and Emerging Markets stocks. We had steadfastly stuck to global portfolio allocations for just this reason. The question remains: with the pullback in the U.S. vs. International stocks, which has normalized, will the U.S. return to its pole position?

S&P first-quarter earnings growth estimates were cut to 7.3% from 11.7%, while consumer confidence has plunged to a four-year low. On the earnings front, companies are struggling to plan due to uncertainties and the possible upheaval of supply chain costs while also factoring in the impact of sinking consumer sentiment on the demand side. The CBOE S&P 500 Volatility Index (VIX) is up 46% since the peak of the market in mid-February. There are tons to be concerned about if you are invested in 100% U.S. equities.

Most of our clients have benefited from a more diversified strategy. Bonds have helped, being globally diversified has helped, and our alternative strategies (specifically Gold) have helped.

There are understandable reasons to be concerned and anxious about portfolios in this environment and speaking with your financial advisor about your tolerance for risk is always a great idea.

“Liberation Day”

While President Trump campaigned on a variety of issues, the three that had the biggest potential impact on the economy and the markets were regulations, taxes, and tariffs.

It is too early to tell if the Administration will be successful in lowering the regulatory and tax burdens facing companies and individual investors, as those will require legislative action, but we certainly have some early results on his tariff policies – and they have not been positive.

It is not necessarily the tariffs themselves since the full force of any changes has yet to be implemented. However, the uncertainty surrounding those policies has increased volatility in the markets. One thing that has historically been true is that what the market hates most is uncertainty, and we are watching that play out in real-time right now.

Wall Street experts initially believed that 10% tariffs could become the standard for U.S. tax revenue, while 25% might be used as negotiation leverage, as demonstrated by the recent tariff delays. But uncertainty is high. Here is the rundown from Goldman Sachs:

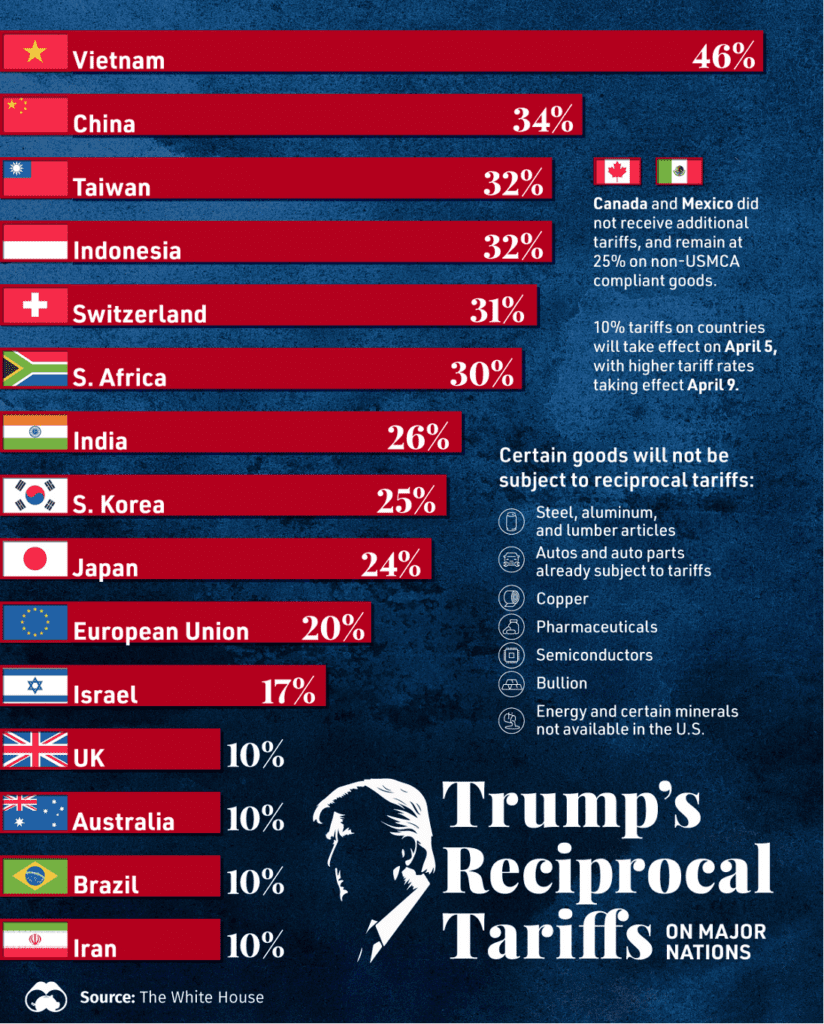

- President Trump announced a “reciprocal” tariff plan that consists of two parts. First, a 10% baseline tariff would apply to imports from all countries, excluding Canada and Mexico. This tariff is set to take effect on April 5. Second, most major trading partners, excluding Canada and Mexico, would face an additional tariff that equals half the ratio of the U.S. bilateral trade deficit with the country divided by U.S. imports from that country. This second component will take effect on April 9. The fact that these two components were structured separately suggests that the 10% baseline tariff is unlikely to be negotiated down but that the additional tariff rate could decline following negotiation with trading partners.

- The tariffs average 18.2% when weighted by imports, but the increase in the effective tariff rate would likely be reduced due to product exclusions. Tariffs are not applicable to steel, aluminum, and autos with implemented tariffs, copper or lumber under pending investigations, nor pharmaceuticals, semiconductors, or critical minerals. The exemption also applies to energy products. While we had expected auto imports to be exempt from the reciprocal tariff, this exemption is somewhat wider than expected and covers roughly 1/3 of imports.

- Canada and Mexico received better treatment than we expected. The executive order continues to exempt USMCA-compliant imports from the 25% tariff on Canada and Mexico. We had expected at least an incremental tariff increase on both countries. The order states that if the exemption ends in the future, USMCA-compliant goods and energy products would receive duty-free treatment while non-compliant products would face a tariff rate of 12%, excluding energy and potash, which would be duty-free. This 12% rate might signal the upper bound for tariff rates for Canada and Mexico.

- Most Asian trading partners face a higher tariff than we expected. A 34% tariff rate on China is higher than expected. The higher tariff rate includes imports from Hong Kong and Macau. Other Asian exporters also face much higher tariff rates, including Vietnam, Taiwan, Thailand, and Indonesia, among others. This appears due to the simplified methodology stated above, based on trade deficits.

- The order specifies that the new reciprocal tariff rates apply only to the non-U.S. content of goods if at least 20% of the content is of U.S. origin. This could incrementally reduce the effect of the tariff rate, but the exclusion of U.S. content would have been most important for Canadian and Mexican imports and is unlikely to be an important factor for imports generally.

- De minimis treatment will remain in place except for China. The order temporarily preserves tariff-free treatment for personal shipments under $800. A separate executive order President Trump signed today rescinds de minimis treatment for shipments from China in particular, which currently account for a substantial share of total de minimis volume.

The Silver Lining

Yes, prices will go up. They will go up for foreign goods and domestic goods alike. However, the Bureau of Economic Analysis (BEA) calculates that roughly 63.5% of U.S. spending is on services, not goods. While consumption varies largely by geography and wealth, a 10% increase in the cost of goods would result in about a 3.65% inflation rate all else equal. This is roughly in line with estimates from the Wall Street Journal, as the CPI swaps market is reflecting expectations that consumer prices will rise 3.6% over the next 12 months. It might not be comforting, but the world did not end on “Liberation Day.” Potentially, cooler heads will prevail and some of this madness will end. But in the interim, we can’t repeat this enough, speak with your financial advisor about your tolerance for risk and how you can best structure your portfolio to weather the current storm.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.