Market Volatility

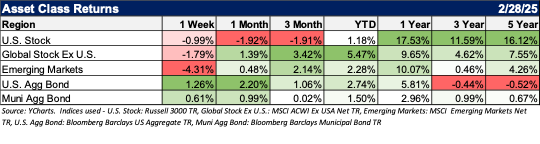

Despite a decent bounce to the end of February, damage was still done earlier to the equity markets thanks to the uncertainties caused by tariff talk and softening economic data. The S&P 500 slipped 1%, erasing most of the remaining gains for 2025 and leaving the index modestly in the red over the last three months. As a sign of difficulty for the Magnificent 7, Nvidia’s stock fell more than 8% despite posting strong quarterly results. The Nasdaq Composite declined 3.5% and is now -2.5% in the red for 2025. Small-cap performance probably best represents investor sentiment on the outlook for the U.S. economy. The verdict has been “not so great,” as the Russell 2000 dropped 1.5% and is now -6.7% since Inauguration Day 2025, thus far more of a slump than a bump.

On a positive note, there were further signs of rotation within the equity markets rather than an across-the-board sell-off. Advancing issues modestly outpaced declining issues, with strength in the defensive Financial, Telecommunication, and Health Care sectors. Additionally, the S&P 500 Equal Weight Index posted a small gain, up +2.8% for 2025. As its title describes, the Equal Weight Index holds equal amounts of all 500 S&P stocks, thus eliminating the concentration risk of the market cap-weighted S&P 500 Index. Multiple years of narrow leadership in the stock market amongst the Magnificent 7 has led to a very high concentration of very expensive stocks in the S&P 500.

Gold retreated from its record highs while the Dollar rallied. We have been favorable toward gold as a hedge against dollar weakness. The softening economic data led to a continued rally in the bond market, with the returns of the Bloomberg Barclays U.S. Aggregate Bond Index (AGG) outpacing U.S. equities.

The tariff drama has continued as President Trump confirmed that previously tariffs on imports from Canada and Mexico would go into effect in March, along with an additional tariff from China.

Sentiment Indexes have slumped to their lowest levels since 2021, driven by a spike in inflation concerns. However, the January PCE came in as expected, showing some modest year-over-year cooling in the Fed’s favorite inflation gauge. The other good news comes from corporate earnings, which are on track for an 18.2% year-over-year increase for the fourth quarter. That’s substantially better than the 11.2% forecasted growth at the beginning of the reporting season.

True Tariff Talk (TTT)

U.S. tariffs set to be imposed on imports from Canada, China, and Mexico, and suggestions of forthcoming tariffs on the European Union, mark a sharp escalation in trade protectionism. This shows that tariffs will be a key policy tool for the new U.S. administration, as telegraphed during the presidential campaign. The effective rate of U.S. tariffs will be close to 1930s levels if fully implemented. We think 10% tariffs could be the new baseline for the U.S. to earn tax revenue, while 25% may prove to be used more as leverage in negotiations, as seen in the decision to delay tariffs in the previous weeks. But uncertainty is high. What’s key for markets is how long 25% tariffs last: the longer they hold, the more permanent the supply chain shifts.

How countries retaliate is also important and could draw further U.S. escalation. These actions, and their ripple effects, could further dent corporate and investor confidence.

The broader economic implications could be larger than the direct effects, in our view. Prolonged tariffs, as proposed, could hurt growth and add to inflation. We already thought loose fiscal policy and supply constraints, like an aging workforce, would keep inflation above the Federal Reserve’s 2% target. That leaves the Fed limited flexibility if growth slows. Another implication is the aforementioned likely reassessment of supply chains. Like the U.S., Canada and Mexico are positioning tariffs as a matter of national security, urging consumption of non-U.S. goods, and limiting reliance on cross-border trade.

In markets, we think U.S. equities could come under pressure in the next few months as investors seek additional compensation for these risks. Yet we think risk asset pullbacks could impact the ultimate extent of tariffs, as seen during the first administration of President Donald Trump. More broadly, resilient economic growth, solid corporate earnings, potential deregulation, and the AI mega force keep us positive on a six to 12-month tactical view. Markets could eventually adjust to a new regime of 10% tariffs if growth stays solid and inflation remains contained. Mega cap tech can keep doing well given strong balance sheets, earnings resilience, and its central role in the AI buildout, in our view.

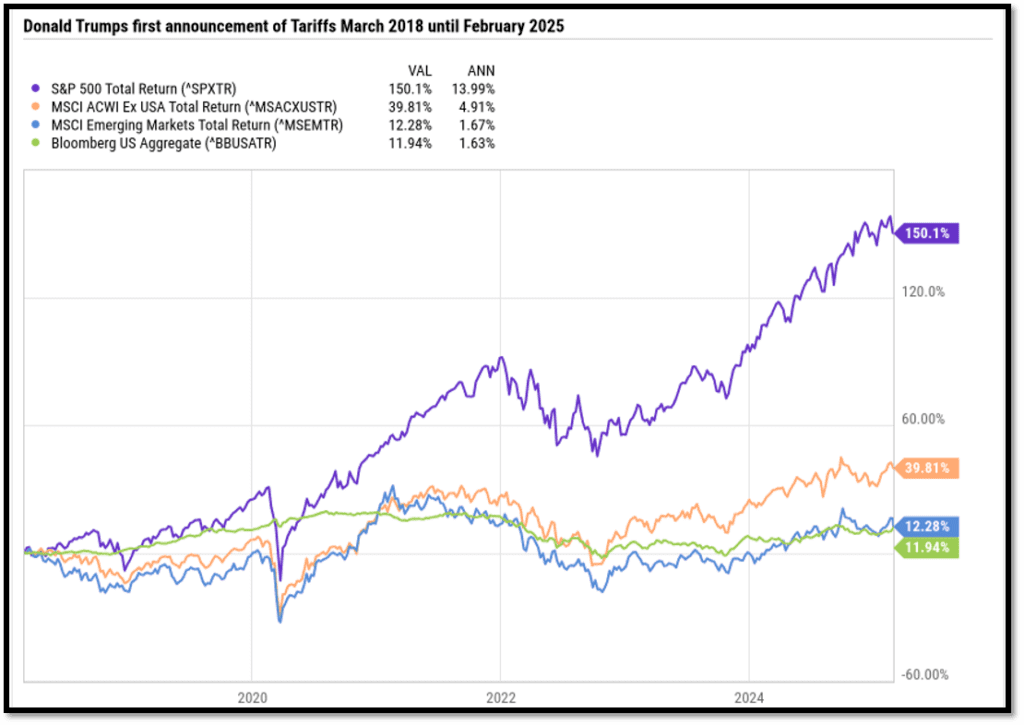

“History Doesn’t Repeat Itself, but It Often Rhymes” – Mark Twain

The last time we dealt with Tariffs and resulting Inflation over the last eight years, markets largely shrugged it off (at least at the beginning). While it may not be satisfying to hear as consumers, as investors, markets continued to trend upwards, and investors benefitted from staying invested. Margins, revenues, and corporate profits continually progressed as the corporations were able to pass along the higher input costs.

Remaining invested in equities (stocks) has benefited clients over time, and equities are the best place to hedge against inflation in the public markets. While we will continue to monitor clients’ portfolios, and adjust along the way, it is wise to speak with your financial advisor to review your tolerance for risk and find a good way to remain invested in times of uncertainty.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.