2025: The Year of the Snake According to the Chinese Zodiac Calendar

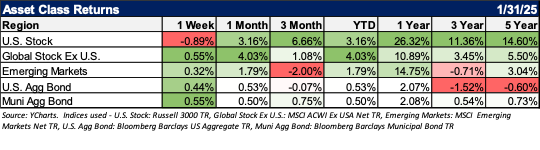

The equity markets were lower after facing a trifecta of headwinds from China, the Fed, and the White House. Stocks are running a bit serpentine right now, with tech under extreme pressure in response to headlines highlighting the low-cost language model developed by Chinese artificial intelligence startup DeepSeek.

A resounding theme from our annual symposium was that the markets will respond to AI headlines, tariffs, inflation, and the economy. Inflation tends to have some “flare-ups” as some data is lagged. This led to the Federal Reserve leaving interest rates unchanged. The central bank maintained the Fed funds rate after three straight rate cuts to the end of 2024, as Fed chair Jerome Powell noted the resilience of the economy and the risk of a return to inflationary pressures. Although the Chairman attempted to sidestep questions concerning the impact of tariffs on the economy, it seemed clear that the uncertainty of those policies contributed to the cautious stand.

Most economists agree that excessive tariffs are harmful to the economy. As we learned in the classic 1986 movie Ferris Bueller’s Day Off when Ben Stein’s character delivered this:

“In 1930, the Republican-controlled House of Representatives, to alleviate the effects of the… Anyone? Anyone?… the Great Depression, passed the… Anyone? Anyone? The tariff bill? The Hawley-Smoot Tariff Act. Which, anyone? Raised or lowered?… raised tariffs, to collect more revenue for the federal government. Did it work? Anyone?… Anyone know the effects? It did not work, and the United States sank deeper into the Great Depression.”

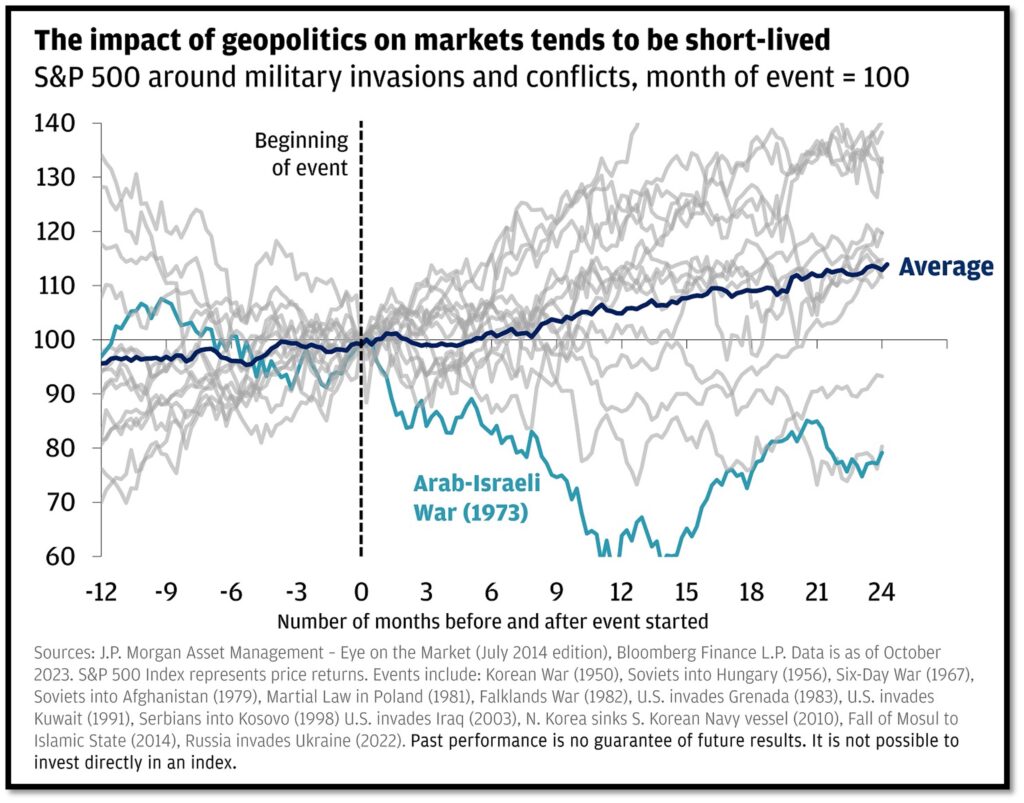

The tariff announcements added to the volatility of the markets, no question. But like many of the announcements from the previous Trump term, the markets will react to the uncertainty and then recover as many of these pronouncements are not policy decisions but an opening to negotiations.

The so-called Magnificent Seven have driven the S&P 500’s earnings expansion and equity returns, with the group comprising about one-third of the benchmark’s weight. They’ve made up more than half of the index’s gains over the past two years, but their profit growth is decelerating just as their spending rises. Concerns exist about their valuations which are roughly 40% higher than the other 493, as well as their ability to deliver on AI promises at a competitive price point, especially with new entrants like DeepSeek.

Thus far, Analysts at U.S. financial data group FactSet estimate a (year-over-year) earnings growth rate of 13.2% for the S&P 500 companies, which would mark the highest (year-over-year) earnings growth reported by the index since Q4 2021. But the ability to deliver will rest on the “Mag 7” as they are now over 30% of the S&P 500’s market cap.

52 Card Pickup

This is the 52nd pure investment commentary produced for Journey Advisors and clients. While we will not bore you with 52 items to pay attention to right now, here are five that we are keeping a close eye on:

- News about new U.S. tariffs on goods from Canada, Mexico, and China (and the announcement of retaliatory tariffs) prompted markets to sell off. While some of the announcements have been paused or walked back, expect volatility around announcements. While the tariffs from 2018-2019 caused prices of appliances and other goods to go up, it also led to the beginning of realignment in the supply chain. Hopefully, these tariff threats are just negotiating ploys, but if they are, in fact, enacted, with any luck, businesses are better positioned for the disruption. There are no winners in trade wars, as previous ones have tended to result in less optimal economic growth but have not necessarily served as a long-term hurdle for the stock market.

- The corporate tax rate in 2017 was 35%, but the Tax Cuts and Jobs Act (TCJA) reduced this number to 21%. Those provisions were set to expire but are now likely to be extended further and potentially even reduced. According to a report from Investor’s Business Daily, nearly 10% of companies listed on the S&P 500 paid no taxes in 2023. The number of corporations paying no taxes has remained relatively steady post-TCJA, but it is roughly double the number of non-payers from before. There could be further tax cuts to individuals as well and there is an initiative to shrink the IRS, further limiting the tax burden on ordinary citizens.

- It can come in waves. We navigated the first wave pretty well as the Fed engineered its soft landing for the economy by bringing inflation down without triggering a recession. The imposing of tariffs could trigger a spike to inflation for goods. And while the U.S. GDP is dominated by consumer spending, it is important to note that we spend much more on services than goods (about 65-70%).

- Monetary Policy. The natural response to inflation is monetary policy. The Fed is anticipating two more cuts this year, but markets are pricing in more like one to two. The Fed has been data-dependent and could respond to an inflation rebound by pausing cuts or reversing. This would not be good for most investors as the markets crave certainty about the direction and speed of monetary policy changes.

- Global unrest. We are surrounded by numerous political, military, and macroeconomic risks. Whether it is global shipping lanes in the Baltic Sea or the Panama Canal, the tensions in the Middle East, the unresolved Ukraine conflict, or any number of other geopolitical risks, we still need to pay attention to how they will impact our clients’ portfolios.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.