Happy Holidays!

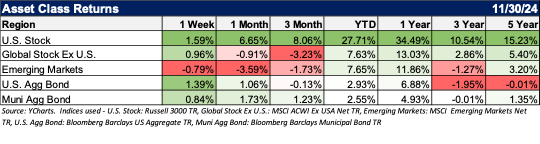

The Santa Claus rally that started a few weeks back continued as the market logged its 53rd record high for 2024. While the Scrooges bemoaned inflation and tariffs, other investors embraced the strong economic data and loaded their sleds with market returns. All 11 Sectors returned positively, with Cyclicals and Financials leading the way. Advancing issues more than doubled declining issues on light holiday trading. The S&P 500, The Nasdaq Composite, and the Russell 2000 gained approximately 1%, with the yield on the 10-year Treasury dropping 23 basis points to 4.18%, a decline of more than 5% for the week.

November included the release of strong economic data. The economic data included the lowest level of weekly initial jobless claims in seven months, a PCE report that showed in-line inflation, and third-quarter GDP registered at a healthy +2.8% annualized rate. There was some concern over President-elect Donald Trump’s proposed tariff policies, in which he said he would levy a 25% tax on all goods coming from Mexico and Canada and charge an additional 10% tax on products from China above any new tariffs. Thus far, traders have restrained themselves from reacting to those prospective policies that most economists suggest could reignite inflationary pressures.

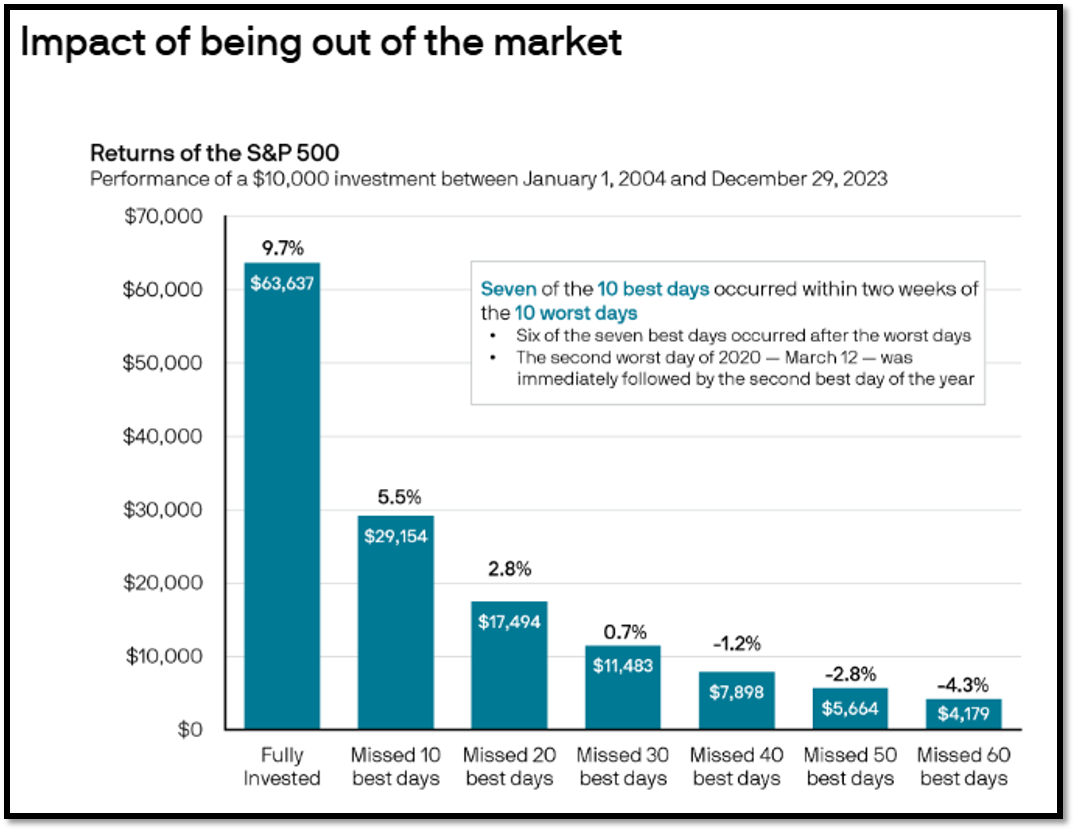

Regardless of the volatility of the data, positive real wage growth has supported consumers and the overall U.S. economy. The steadiness of the economic data and resilient corporate profits support a good backdrop for investments. While we can’t say specifically that the markets will end the year higher than the levels of early December, we encourage investors to remain invested.

Source: J.P. Morgan Asset Management analysis using data from Bloomberg. Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Indices do not include fees or operating expenses and are not available for actual investment. The hypothetical performance calculations are shown for illustrative purposes only and are not meant to be representative of actual results while investing over the time periods shown. The hypothetical performance calculations are shown gross of fees. If fees were included, returns would be lower. Hypothetical performance returns reflect the reinvestment of all dividends. The hypothetical performance results have certain inherent limitations. Unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees and other costs. Also, since the trades have not actually been executed, the results may have under- or overcompensated for the impact of certain market factors such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Returns will fluctuate and an investment upon redemption may be worth more or less than its original value. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Data as of December 31, 2023.

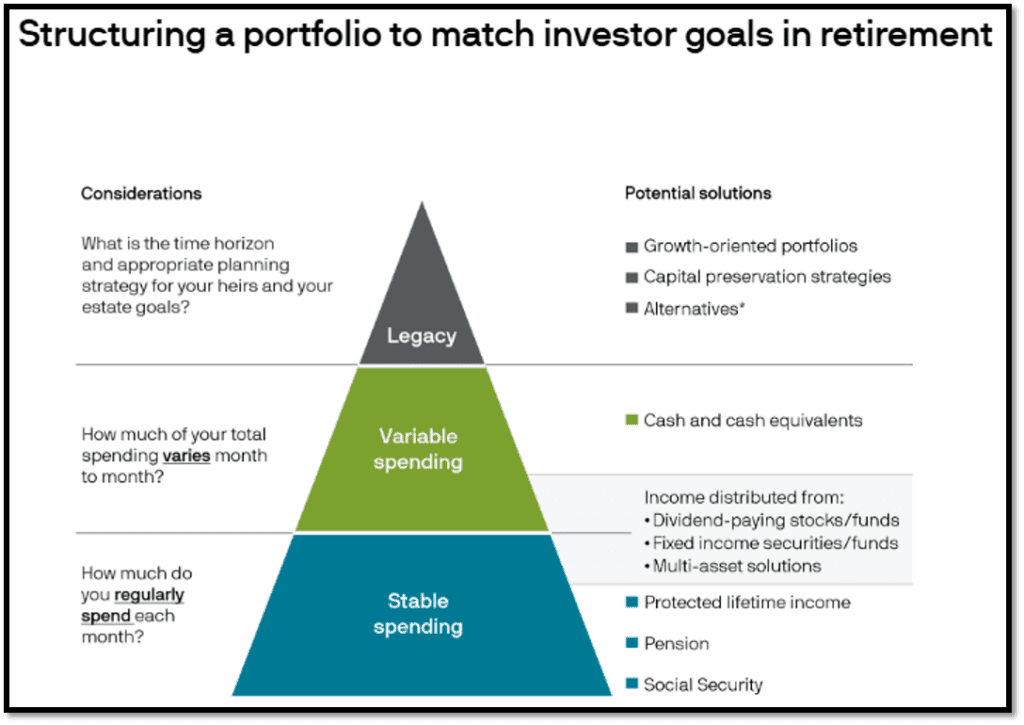

But be sure to speak with your advisor to make sure you are allocated properly towards your goals:

Aligning retirement assets based on how they will be used to support an individual’s retirement lifestyle is one way to ensure a higher degree of confidence through retirement. This chart shows stable spending can be aligned with relatively safe funding sources. More variable spending can be covered by investment income, consuming principal or a cash reserve. If leaving a legacy is a goal, other strategies may make sense given the longer time horizon.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.