It’s Halloween Night, Not A Soul In Sight!

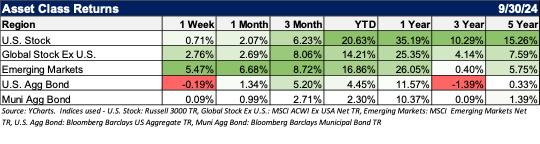

When you have an eight-, six-, and two-year-old, you hear these kinds of things in October each year. The good news is that the stock and bond markets were not spooked in September. The S&P 500 had its best September in the last 11 years with a +2% performance. Large companies have outperformed Small and Mid-Caps for most of the year, but the trends are certainly in their favor after a bump over the summer and a recent rally. This is a bit surprising because the Small and Mid-cap stocks (SMID) tend to underperform as the economy cools, and be overly punished, before a resurgence when the economy picks up. Most would point to the rate cuts as a stimulus for all financial assets, but particularly the SMID stocks.

According to J.P. Morgan, 41% of companies in the Small Cap Index are unprofitable, compared to 15% of the Mid-Cap Index and only 4% of Large Companies. The rate cuts are providing for amplified returns on the SMID stocks because the unprofitable companies have been relying on debt to finance operations. The cost of debt is now coming down, giving breathing room to the unprofitable companies that rely on debt financing (specifically floating rate debt that resets quarterly).

The Goldilocks economic scenario remains in play, as the August PCE came in at an annual rate of just 2.2% and the final reading of the University of Michigan’s consumer-sentiment index in September rose to the highest level in five months. There is still room for improvement as the index still stands 30% below the levels reached in February 2020, but it is an improvement.

Similarly, Emerging Markets, specifically Chinese equities and China-focused U.S. companies, also got a boost recently as a fresh set of stimulus measures took effect in the world’s second largest economy. The MSCI China index surged over 25% for the month but are still down for the trailing three years.

Bonds rose across the board as many central banks ushered in a new era of loose monetary policy. The Fed, the European Central Bank, and the Bank of England, among others, lowered rates amid signs of cooling inflation. The Bank of Japan was an outlier, raising rates and sparking a rally in the yen. This threw a great deal of volatility into a popular Japanese equity trade this year.

In foreign exchange markets, U.S. dollar weakness accelerated for much of the quarter. The U.S. Dollar Index fell 4.8% for the quarter and 0.5% on a year-to-date basis.

Trick Or Treat?

It’s hard to not speak about politics in investments a month before a U.S. presidential election. Instead of opining on who will win, we have pulled some information from one of our risk tools. According to Orion Risk Intelligence, constructively divided government (where the president and the senate are of one party and the House of Representatives are from the opposing party), whether it be with a Republican or Democratic president, provides for 17% expected returns for the stock market a year later. The explanation is simple: the grid lock on Capital Hill will not allow the party in power to accomplish their entire agenda, BUT essential projects are accomplished. Expected returns are positive currently, but there are two scenarios where the outcome is a negative equity return.

Full Democratic control of all chambers or a Republican President with a Democratic Senate and House produce single digit negative returns. Historically, R President and D Congress is the worst scenario for market returns. Parties clash and have multiple debt crisis and reform issues. Full Democrat control of the government will likely increase taxes, regulation, social spending, and thus dampen expected returns.

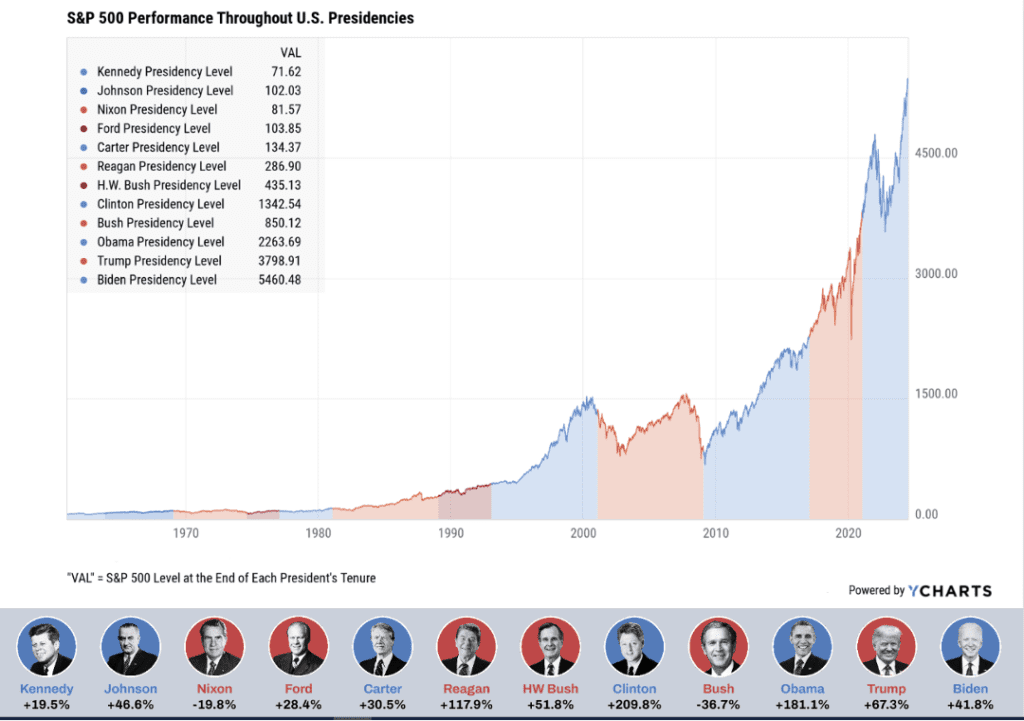

But fear not, these are hypothetical returns. If you look at the markets beyond the lens of one-year post-election, you’ll find that the S&P 500 has consistently grown regardless of who is in office:

Source:YCharts. Data from 01/20/1961 – 6/28/2024

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.