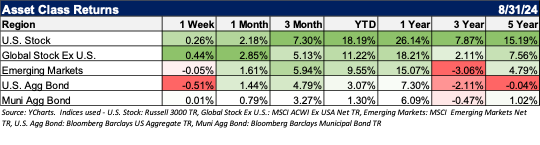

As the kiddos return to school, our fantasy football lineups are set, and the summer has ended, not only is the weather turning in the Northeast, but the inflation challenges are also cooling. The Federal Reserve’s (Fed) preferred inflation gauge, the PCE, was released at the end of August and came in at 2.5% month-over-month for July. Chairman Powell’s recent comments emphasized balancing risks in weakening labor market conditions, but inflation risks have also diminished.

Powell finally sang the tune investors were calling for, with the strongest signal yet that interest rate cuts are coming. “The time has come for policy to adjust” (translation: “cuts”), Powell said at the Jackson Hole Economic Symposium, sparking a rally that moved stocks even more positively for the month after a disastrous beginning.

Bond investors also celebrated as the yield on the 10-year Treasury dropped (bond yields and prices move in opposite directions). It’s not a question of whether bond investors will benefit from rate cuts; it’s more of a mystery about when they will start and how quickly they will come down.

As Treasury yields have declined, so has the dollar exchange rate, leading to rallies in international equity markets denominated in the euro or yen. The weakness in the dollar should also create a short-term tailwind for the earnings of U.S. companies that derive revenues overseas, although the longer-term impact of a weak currency is more complex.

The 10-2 year Treasury spread, an oft-cited barometer of recession expectations, is approaching the narrowest spread in the last two years and is just about flat. This improving indicator from the Fed suggests a metaphorical applause by financial markets toward Chairman Powell’s most recent comments. A further move into a positive spread between these key bond yields would create a more optimistic outlook among investors regarding global economic prospects.

Be Careful What You Wish For

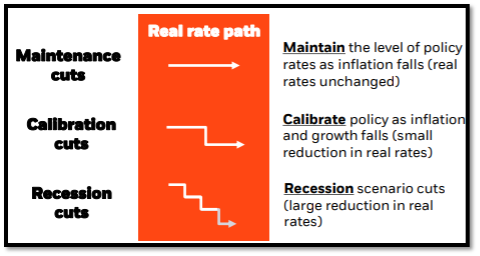

A quick primer: fast-easing cycles were ones during which the Fed cut rates at least five times per year, while slow-easing cycles had less than five cuts. “Non-cycles” were cases of only one rate cut, not followed by more.

According to Ned Davis Research, slow-cutting cycles have been much more rewarding for equities (especially within the first year after the initial rate cut) than fast or non-cycles. This should be intuitive: if the Fed cuts aggressively, it’s likely because they’re combatting a recession.

In Summary

The risks of an imminent recession are low, so it is too soon to get defensive on economic concerns alone. However, we are carefully monitoring the Fed’s movements, labor markets, and the overall health of the economy. Changes to portfolios will reflect the economic and market backdrops.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.