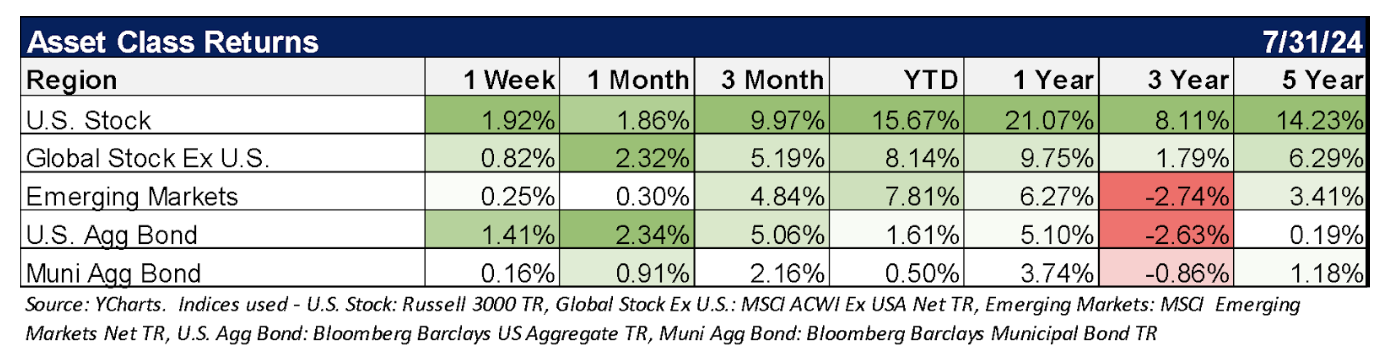

U.S. and global stocks advanced in July and strengthened year-to-date gains. Despite heightened volatility, the S&P 500 Index returned 1.2% in July to post its third straight monthly gain. July’s performance lifted the index’s year-to-date return to 16.7%. Unlike the performance driven by the “Magnificent 7” for much of the market rally, July returns were strongest from Real Estate, Financials, and Utilities. Somewhat surprisingly, small-cap stocks rallied more than 10% in July and value stocks outpaced growth stocks across size categories. Bonds also advanced amid the market’s growing rate-cut expectations.

The U.S. Federal Reserve Bank (Fed) left rates unchanged on July 31, awaiting greater confidence that core inflation is on a sustainable path toward the 2% target. Core Personal Consumption Expenditures (PCE), the Fed’s preferred gauge, remained unchanged at 2.6%. Citing continued progress on the inflation front, the Fed fueled market speculation about future rate cuts. At the end of July, the futures market placed a 90% probability on the Fed cutting rates by 25 bps in September.

It is clear that all of the central banks are not in a geosynchronous cutting cycle, but the trend is certainly that interest rates globally are poised to come down. The Bank of England (BoE) and Bank of Canada (BoC) cut rates for the first time in more than four years, while the European Central Bank (ECB) held steady, and the Bank of Japan (BoJ) was forced to raise rates to stabilize the Yen against the U.S. Dollar.

With the recent market volatility, it might make sense to give some historical context to corrections and the relative health of the markets.

- Market corrections happen almost every year. According to S&P data, over the last 40 years, there has been a greater than 5% drawdown in the S&P 500 Index in every year but two (1995 and 2017).

- Market volatility and corrections don’t emerge out of nowhere. They tend to be the result of policy uncertainty. The U.S. market has been expecting multiple rate cuts by the U.S. Federal Reserve (Fed), which haven’t yet emerged but are implied by Fed Funds Futures.

- Of all the indicators, the bond market tends to get it right most often. The bond market is signaling that U.S. nominal growth (real economic activity plus inflation) may be weak. U.S. long rates are falling, but short-term rates have fallen even more. The bond market is ahead of the Fed and suggesting that multiple rate hikes could be imminent.

- Market cycles don’t die of old age. They’re typically murdered by the Fed with interest rate hikes. If the Fed has not waited too long, the early warning signs of the cycle turning have not yet materialized.

- The corporate bond market has been the “canary in the coal mine.” Corporate borrowing costs relative to the risk-free rate tend to provide an early warning sign, rising significantly ahead of a recession. Currently, the spread between high-quality corporate bonds and the risk-free rate is rising but remains below average. The corporate bond market is signaling worsening economic conditions, but not a recession.

- The stock market has historically recovered quickly from corrections. The average time to recover from a 5%-10% downturn is three months. The average time to recover from a 10%-20% correction is eight months.

- If a recession occurs, markets typically fall by more and take longer to recover. The average decline during the milder recessions of 1957, 1960, 1980, 1981, and 1991 is nearly 20%. The stock market recovered, on average, within one to two years.

- It is difficult to predict market prices and difficult to trade around price movements. The best days in the market often happen near the worst days of the market. Investors likely know that returns can be significantly impaired if they miss the best days in the market, but they may not realize that the best and worst days tend to cluster together. In fact, of the 30 best days in the stock market in the past 30 years, 24 happened during the “tech wreck,” the Global Financial Crisis, and the COVID-19 pandemic.

- It’s typically better to add to portfolios after severe down days. According to Bloomberg, long-term investors have usually been better served by adding to portfolios rather than by withdrawing money during corrections.

- Time in the market has generally been better than timing the market. On days when the headlines look dire, our action biases implore us to make changes to our portfolios. However, numerous studies, including one from Dalbar, concluded that investors who remained committed to their investment plans have typically fared better than those who have attempted to time the market.

Outlook

A small uptick in unemployment over the last few jobs reports has people discussing obscure concepts like the Sahm Rule. We have had an inverted yield curve for over two years, but the likelihood of a recession is still in the 15-25% range for the next year according to Goldman Sachs.

We have a slowing economy, uncertainty around rates, and a polarizing U.S. presidential election in three months, any of which could add volatility to the markets. During sell-offs and volatile markets, we want to counsel investors to stay the course as taking down investments is perhaps the most damaging decision investors can make. The early August sell-off could represent just the market taking a breather after seven months of fantastic returns and could be right back on track, albeit with additional volatility.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.