The Importance of Planning

In our meetings this year, we’ve discussed the potential for increased volatility in the latter half of the year. Monday’s market activity was a clear example of this. As always, core wealth management principles remain as important as ever. Please find a few of those important reminders below.

1) The Importance of Goal-Based Planning & Understanding Your Time Frame

First, goal-based planning is as important as ever. In 2020, this was highlighted again as we saw that investment strategies that were aligned with your goals and time frames helped you avoid the knee-jerk reaction of perhaps selling out at the bottom of the market when the initial COVID outbreak and fears about the rapid spread sent stocks and Treasury bond yields plummeting in March. As we studied the fund flows for investments 2020, it showed outflows in equities from March through October. Remember that one hundred trading days after the bottom, the S&P Index and Dow Jones Industrial Average recorded their best 100-day advance since 1933.

In order to time the market, you must be right twice both successfully timing the bottom and top of the market. No one can do that consistently. So instead, we must understand the time frame for our investments, and use those principles to help us be prepared for anything that may come in the markets. As we know that market volatility and corrections are part of long-term investing.

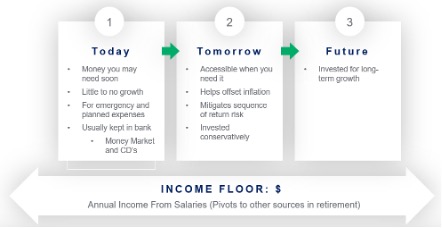

This is why our conversations about time frames are so important. For those of you who need funds in the short term, we invest conservatively, so that when market volatility occurs, we don’t have to pull money from positions that are down. For those with a longer time frame, you can afford to withstand the volatility, knowing that if history repeats itself, the markets will recover. Here is a graphic you’ve seen from us many times before, which visually represents our approach to investment strategies based on your needs.

2) Having a Good Income Floor if You are In or Nearing Retirement

For clients in retirement, having a healthy income floor brought financial confidence. An income floor is a guaranteed income source, such as social security, pensions, deferred compensation plans, or annuity income, that enters your bank account regardless of market conditions. This means that during downturns like in March, you still have the necessary income from sources not subject to market risk, allowing you to stay invested with your other assets and avoid fear-based decisions. This year, we found that clients in retirement with this approach felt significantly more financially confident.

3) The Benefits of Dollar Cost Averaging

Dollar cost averaging (DCA) offers significant benefits, especially during uncertain times. While research on DCA is mixed, our experience shows it helps clients feel more comfortable investing in the markets. DCA involves dividing the total investment amount into periodic purchases, reducing the impact of volatility and avoiding the risk of investing all your money at market highs. This strategy is particularly effective during bear markets, enabling you to buy at low points when others might be too afraid to invest.

4) Being Opportunistic with Planning

Market drops do also provide for unique opportunities such as tax efficiently rebalancing portfolios during the market dip, and/or coupling that with Roth conversions. We are actively reviewing portfolios right now to take advantage of tax loss harvesting during volatility.

These inevitable uncertainties make it important to continue to stay aligned with you and your planning as life continues to change. Please know that we are here for you to discuss any concerns or questions around your plan.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.