Rising Temperatures

New Jersey, like much of the rest of the country, was mired with a heat wave in June. According to data from Newark Airport, just 15 miles from our offices, there were 11 days with high temperatures over 90 in June and just five days that didn’t reach 80 degree highs. Heat indexes that factor in humidity have been particularly dangerous over the last month. This was the second warmest June since 1931, about 4.8 degrees above normal. While the temperatures were rising, the U.S. stock market continued its climb higher as well. The S&P 500 returned 3.5% and Emerging Market stocks delivered an impressive 3.9%. Bonds also returned positively in June.

Try To Keep Cool

The May inflation report showed a Personal Consumption Expenditures (PCE) registering a +2.6% year-over-year increase and a -0.1% month-over-month decline. That reading was in line with expectations, supporting the seeming consensus view that at least one Fed interest rate cut is expected this year. The Fed is supposed to be independent and not influenced by politics. Nevertheless, the upcoming election is another factor that could contribute to the timing of future rate cuts. We don’t think this Fed will want to go down in history as both keeping rates too low for too long as inflationary pressures mounted in 2021 and keeping rates too high for too long as the economy slowed in 2024. Rate decreases are coming from the cooling economy, but the pace of the cuts and when the Fed will start a rate cutting cycle are still uncertain.

Be Mindful Of Heat Stroke Symptoms

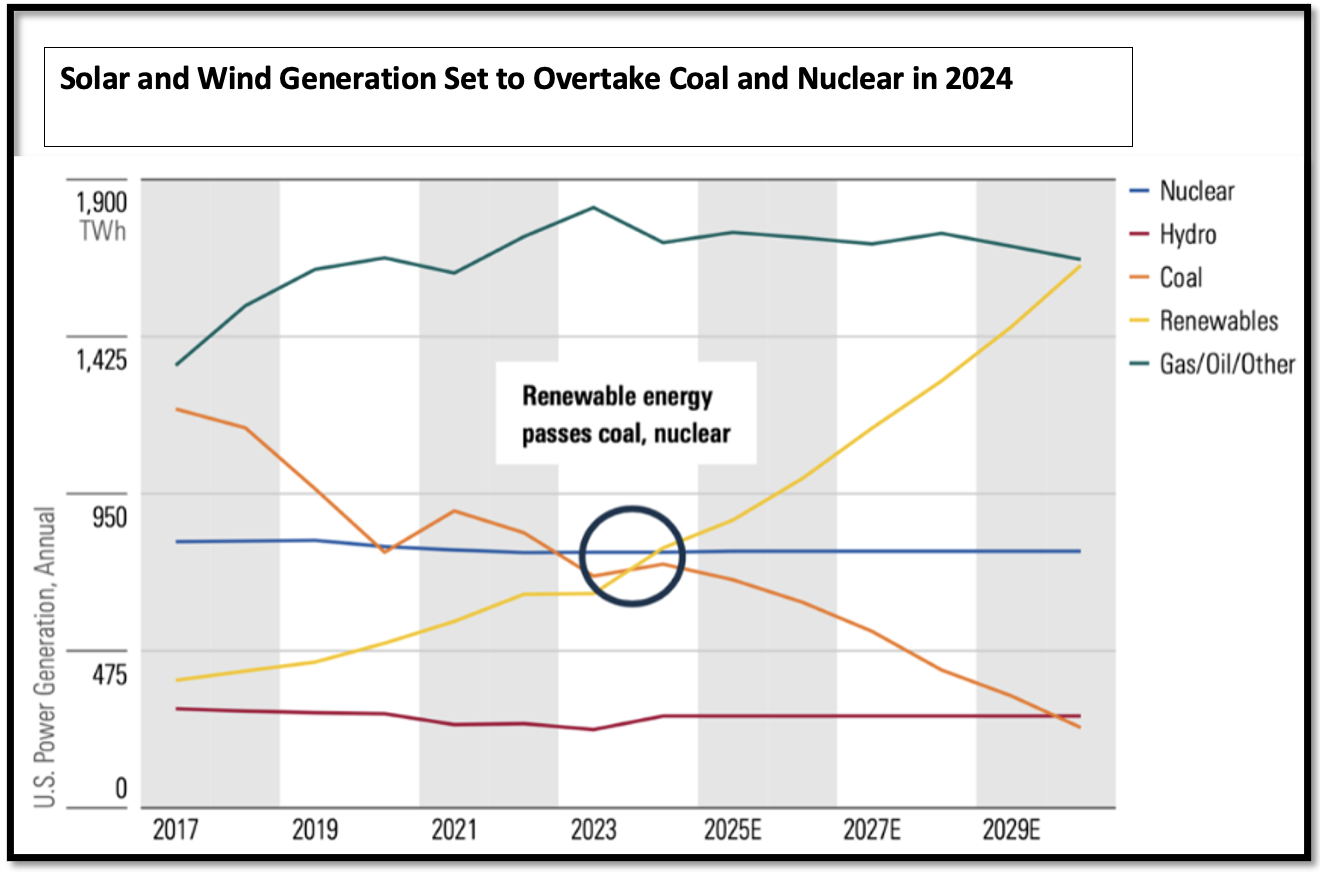

One way to do this is by running your air conditioner. Over the years the consumption of power, like running air conditioners 24/7, has caused brownouts and blackouts. The increased demand for power, shortages in network capacity, or extreme weather conditions put additional strain on the electricity network. While there have not been widely reported blackouts, the power grid and the utilities companies will need to keep up with the increased demand for power. Regulated Utilities that generate this power performed very well over the last quarter, only underperforming Tech and Communication Services companies in the U.S. While utilities typically offers diversification benefits such as strong cashflow generation, inflation protection, low beta, and attractive yields, these are not the only reasons interest has returned to the sector. The Artificial Intelligence (AI) story could be a big driver of performance for Utilities both domestically and globally in the coming years.

The International Energy Agency 2024 Electricity report expects data center electricity usage to double by 2026. Further out, Bloomberg Intelligence forecasts a tripling of data center demand to 2029, reaching 7.5% of U.S. electricity demand. In Europe, Goldman Sachs estimates data center electricity use expanding from 1% towards 6% of total EU electricity demand. This demand is currently being met with many of the usual suspects, but increasingly intermittent renewables and storage can assist in this heavy lift.

Source: Morningstar, Energy Information Administration. Utility-Scale generation only. Data as of 1/22/2024

Perhaps an investment in energy infrastructure and a sector rotation towards Utilities are in order.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.