Staying Disciplined in a Volatile Market: Tips for Successful Investing in 2024

2022 was a difficult year for investors, and we recognize that detours on the road to your financial goals are not uncommon.

Legendary investor Warren Buffett opined, “Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons.”

Our goal is not to time markets, and Buffett would agree. He counsels that “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

But he recognizes that stocks aren’t immune to significant pullbacks. He would caution that a bear market isn’t the time to bail on stocks.

In his 2013 letter to shareholders, he noted, “The goal of the non-professional should not be to pick winners—neither he nor his ‘helpers’ can do that—but should rather be to own a cross-section of businesses that in aggregate are bound to do well.”

2022 may have tried your patience, but patient investors were rewarded in the following year. The skies cleared, and those who were invested in that “cross-section of businesses” were handsomely rewarded.

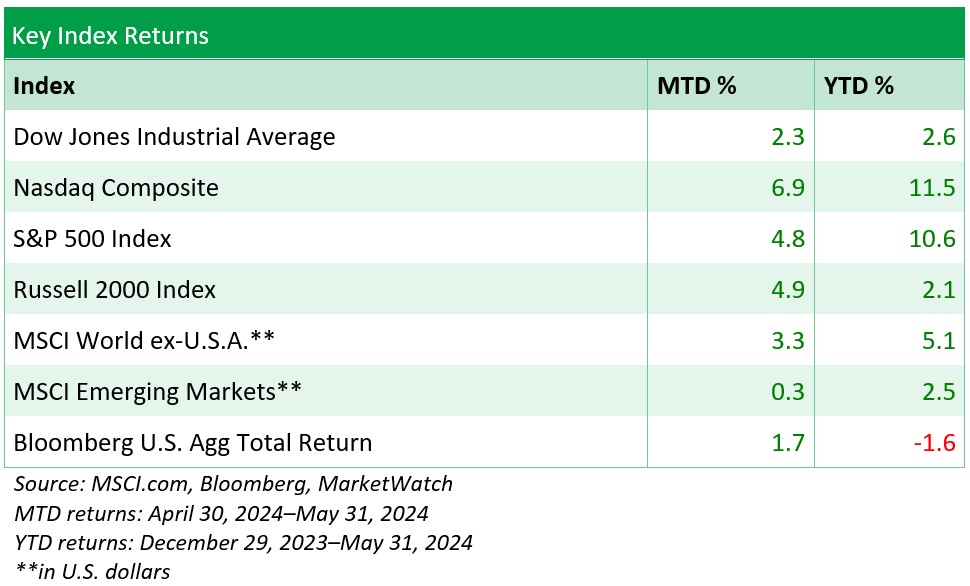

In 2024, a well-diversified portfolio has continued to perform well. But we are also aware that pullbacks can never be discounted.

Adhering to a long-term strategy takes discipline. And much like the turtle in the fable of the tortoise and the hare, those who have taken the steady and disciplined road have reaped their rewards.

Yet, we understand that the noise from the 24-hour news cycle can throw up roadblocks, even for the most patient investor.

Avoiding distractions, stay focused

- Time Frame is Everything! We dedicate a lot of time to developing a plan that provides clarity around your investment time frame. For short-term needs, we ensure your funds are invested more conservatively. For long-term goals, we allow for some market volatility. This clarity empowers you to make stronger investment decisions.

- Skip the fads. Jumping into cryptocurrencies or playing the “meme-stock” game offers the allure of overnight riches. But these trains can turn quickly, and you can end up with big holes in your portfolio that aren’t easily plugged.

- Balance and re-balance and re-balance again. For example, a 60/40 portfolio of stocks and income-producing investments will eventually drift out of alignment. A 60/40 may become 70/30 or 80/20. It’s important to make adjustments to realign your portfolio with your long-term strategy and risk tolerance. We continuously monitor and make these adjustments on your behalf.

- While we encourage you to stay committed to your plan, it’s not set in stone. When your life or the world changes, we are here to adjust and adapt your plan to meet your current needs.