Scoreboard… Scoreboard… Scoreboard…

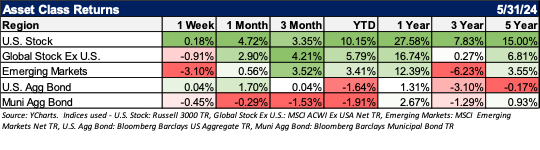

According to FactSet, for Q1 2024 (with 98% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS surprise and 61% of S&P 500 companies have reported a positive revenue surprise. Further, the blended (year-over-year) earnings growth rate for the S&P 500 is 5.9%. If this number is not adjusted down, it will mark the highest year-over-year earnings growth rate reported by the index since Q1 2022 (9.4%). While early earnings guidance for Q2 is more a mixed bag, and not all months will look like this, May was a great month for equity investors. The adage, “Sell in May and go away” hasn’t seemed to work out so well over the last few decades.

Source: YCharts

Goldilocks?

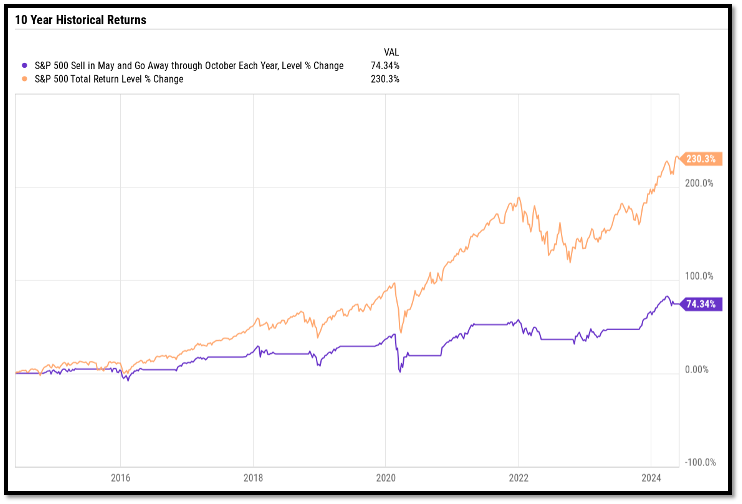

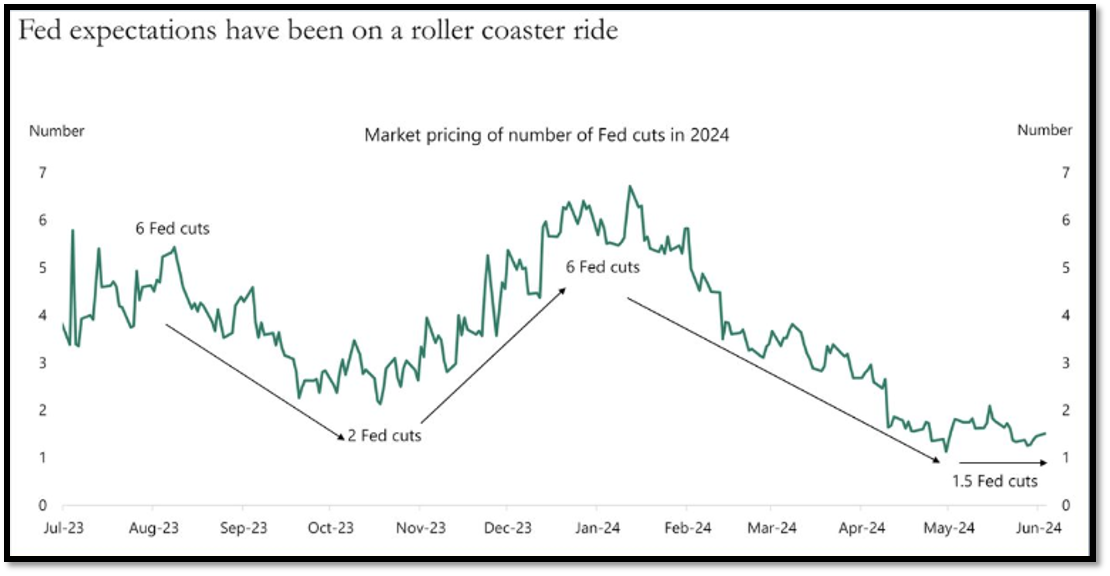

No, this is not Goldilocks. The PCE Price Index came in on target and showed a trend consistent with the downward trend in inflation during the past 12 months, which is great, but something is still just NOT right. While the yield on the 10-year Treasury has moved up a bit recently, the yield curve remains inverted. And, anticipated Fed rate cuts haven’t yet materialized, penalizing bond investors.

Source: Bloomberg, Apollo Global Management

So While Bonds Remain “Too Cold,” In Our Opinion Stocks Aren’t Yet “Too Hot”

We remain slightly overweight to equities based on risk tolerance. Our current baseline is stocks over bonds, U.S. over international, mega-cap over small-cap, and growth over value. Bonds are more attractive than they have been in a few decades and we remain confident in their ability to deliver results to investors, but the sequence of returns has changed as the markets digest the “higher for longer” interest rate environment. We anticipate unwinding some of our inflation hedges in the coming months and potentially adding to fixed income.

Given the duration profile we have in our fixed income portfolios, we are positioned to take advantage of the high short-term rates and set up for the cuts (when they come). It’s not a question of the benefits of fixed income today (relatively high coupon payments, potential ballast should the economy slow and stocks pull back, etc.), but moving forward, it’s more a question of when bonds will deliver returns.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.