Off The Top Rope!

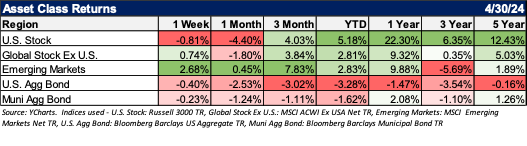

In trader speak, a “correction” is defined as a decline of 10%, and in this latest episode, there was only a slightly more than 6% drop from the top. The stock market recovered some of those losses in the last two weeks of the month, but the benchmark indexes have continued to trend higher over the last year and a half. This market’s “steady climb higher” has referred to the S&P 500, while the other market cap sectors have experienced a rockier ride.

U.S. Small Capitalization stocks (Small Caps) are around -13% below the level from three years ago, while mid-caps are only modestly positive. We have been underweight to the Small and Mid Caps (SMID) for the last three years and attribute this disparity in return to the perception that more prominent companies are better positioned to withstand the widely anticipated challenging economic environment, including higher interest rates and the possibility of a recession. The rationale is that smaller companies rely more on floating-rate bank lines of credit, while large corporations more frequently issue fixed-rate bonds. The higher interest rates, in turn, compress the profitability of these smaller companies.

While we anticipate that the inflation data will be “lumpy” (we prefer the term “sticky,” as there will be ebbs and flows), with some factors concurrent to reports and some lagged, we are generally sanguine about the overall market backdrop. We continue to view the economy as steady, with the price level high but a reasonable inflation rate running in the 2.5-3% area.

Over halfway through the first quarter earnings season, the S&P 500 is on track to show +3.5% growth. The improvement came across multiple sectors, with Big Tech providing the latest push. Energy is the sector leader, while significant growth in style and Momentum are the best-performing factors. We maintain our preference for large-cap U.S. companies, specifically high-quality companies.

While a bit lumpy, inflation has been downward for some time. Unemployment remains below 4%. The Fed has backed off a bit in cutting rates, but the next rate move is still expected to be down. This isn’t precisely “Goldilocks” territory, but we are not in bad shape domestically.

What Keeps You Up At Night?

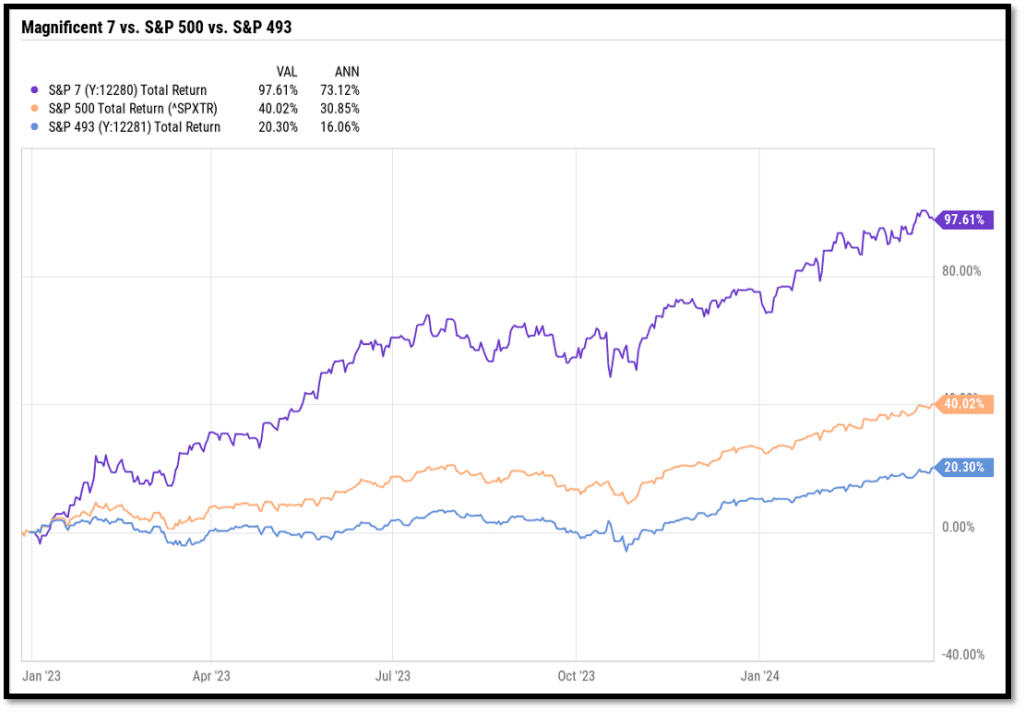

The Magnificent 7 (we’ll call them the S&P 7) currently accounts for roughly one-third of the S&P and has a market cap larger than the Japanese, Canadian, and UK equity markets combined. The breadth of market returns is a concern, and we can’t hope that a few companies control the fate of investor returns. If you compare that Magnificent 7 to the overall S&P 500 and the S&P 500 without those stocks, you can see a stark comparison in performance.

Source: YCharts. Return data is net total return for the last 5 quarters, from 01/01/2023 to 3/31/2024

REPEAT – We Are NOT In The Prediction Business

We’ve often said that we are not in the prediction business and are not trying to pick the following stocks that will outperform. Having broad allocations (which start with the benchmark allocations) allows us to participate well with markets instead of trying to pick the next Magnificent 7 as the drivers of returns change over time. If you didn’t own Disney or IBM stock in the ’70s/’80s/’90s, you probably didn’t perform well. Fast forward to today, and if you didn’t own Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla, you probably didn’t perform well. Who will be the next batch of out-performers?

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.