It’s Getting Hot In Here…

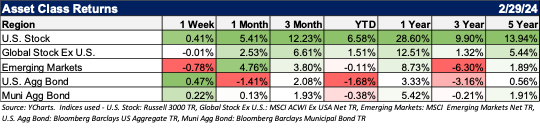

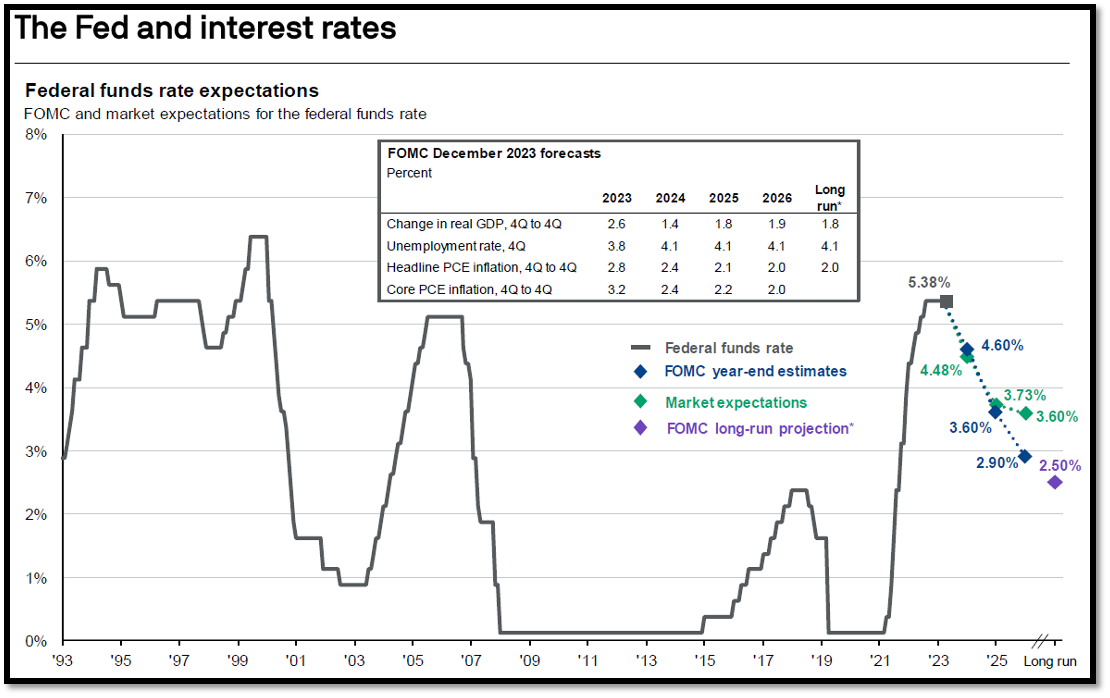

January’s U.S. Consumer Price Index (CPI) report was hotter than expected. This gave the markets pause as it further stoked fear that the interest rate cuts that the market expected were coming quickly might actually be further off in the future. Using overnight index swaps as a proxy for market expectations, the 2023 YE expectations were that the Federal Funds rate would be 3.62% at the end of 2024 and 3.03% at the end of 2025. Those same market forces, just two months later, are saying that we should end the year at 4.48% and 3.73%, respectively. Expect that the CPI figures will be lumpy as some of the data (like housing) are lagged figures.

Source: Bloomberg, FactSet, Federal Reserve, J.P. Morgan Asset Management.

Market expectations are based off of USD Overnight Index Swaps. *Long-run projections are the rates of growth, unemployment and inflation to which a policymaker expects the economy to converge over the next five to six years in absence of further shocks and under appropriate monetary policy. Forecasts are not a reliable indicator of future performance. Forecasts, projections and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what may occur. Given the inherent uncertainties and risks associated with forecasts, projections or other forward-looking statements, actual events, results or performance may differ materially from those reflected or contemplated.

While this CPI print in mid-February did contribute to volatility in both the stock and bond markets, the stock markets recovered rather quickly as earnings have come in very strong. After losing about -1.36% on the news, the S&P 500 recovered 3.00% the rest of the month. In contrast, the Bloomberg Barclays U.S. Aggregate Bond Index (AGG) dropped 0.92% from February 12-13th, and only recovered +0.66% the rest of the month.

The major reasoning here is that stocks have delivered well on earnings expectations. Not only did corporate America deliver solid upside to estimates, but guidance was strong as well, keeping in line with the earnings growth of the last 20 years (+7.5%).

Watch Out For That Trap!

Stocks can remain cheap (or expensive) longer than most realize. Many investors might look at the stock market as “expensive” right now. They tend to think that now might be the right time to pare down on equity risk based on the rich valuations. The stock market is currently in the top decile for valuations, or more expensive than it has been 90% of the time. However, you can see excellent returns even at rich valuations.

Source: Bloomberg, Yale Department of Economics, data through 9/30/23, as of 1/16/24. Past performance does not guarantee future results. An investment cannot be made directly in an index.

What’s Reasonable to Assume?

It is reasonable to assume that markets can continue to climb higher. According to the N.Y. Fed, 3 year U.S. inflation expectations are at a healthy +2.4%. Energy prices have retreated meaningfully from their peak. U.S. Core CPI excluding shelter (which tends to lag) is up only 2% over the past six months, annualized. These are not numbers that should scare investors nor should they scare the Federal Reserve Bank from cutting rates in the not-to-distant future (thus supporting these rich valuations)!

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.