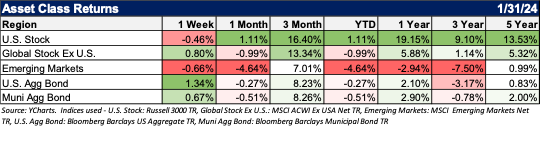

U.S. Stocks were positive in January as more Goldilocks economic data fueled investor optimism. U.S. gross domestic product (GDP) came at a +3.3% for Q4 2023, much stronger than the expected 2% gain. The Bureau of Economic Analysis said that the core personal consumption expenditures (PCE) price index rose 0.2% for December and only 2.9% year-over-year. Data is showing signs of a strong economy with moderate inflation, a recipe for the soft landing people dreamed about.

Stock Trader’s Almanac

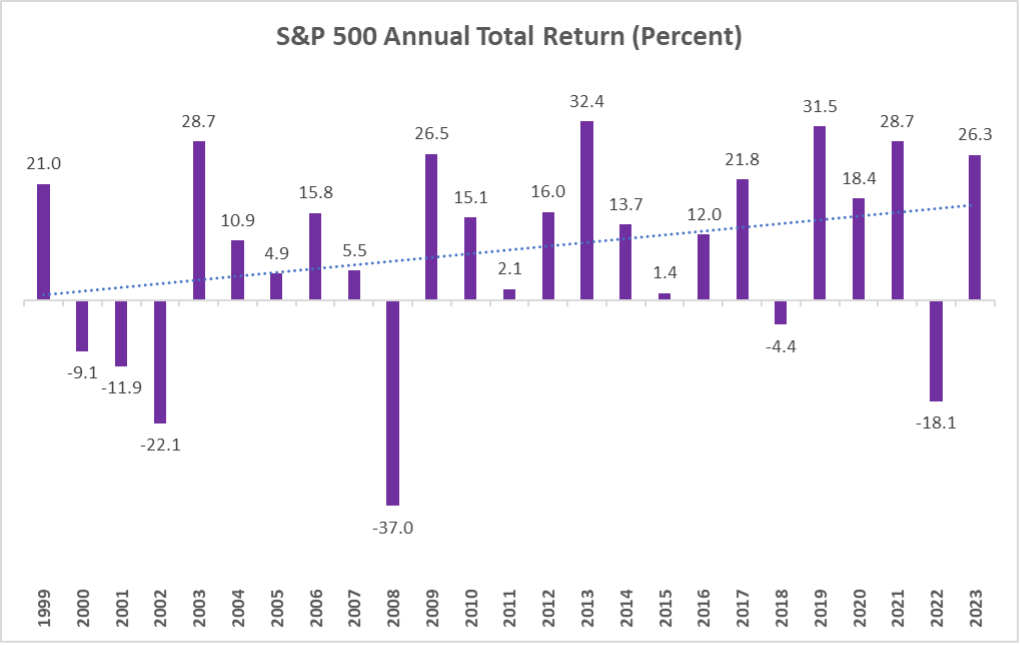

The “Stock Trader’s Almanac” by Yale Hirsch is frequently cited for the “January barometer” suggesting that S&P 500 stocks will go as the month of January goes. This concept has been around for over 50 years and has shown that a January return (positive or negative), historically has forecast a correlated return nearly 84% of the time. This could be spurious considering that the S&P 500 has historically been profitable 9/12 months per year and returns a positive calendar return 69% of the time, according to Morningstar. In fact, over the last 25 years, the market has returned positive 76% of the time (of note, during presidential election years the January barometer is only “correct” 67% of the time):

Source: YCharts

Election Year

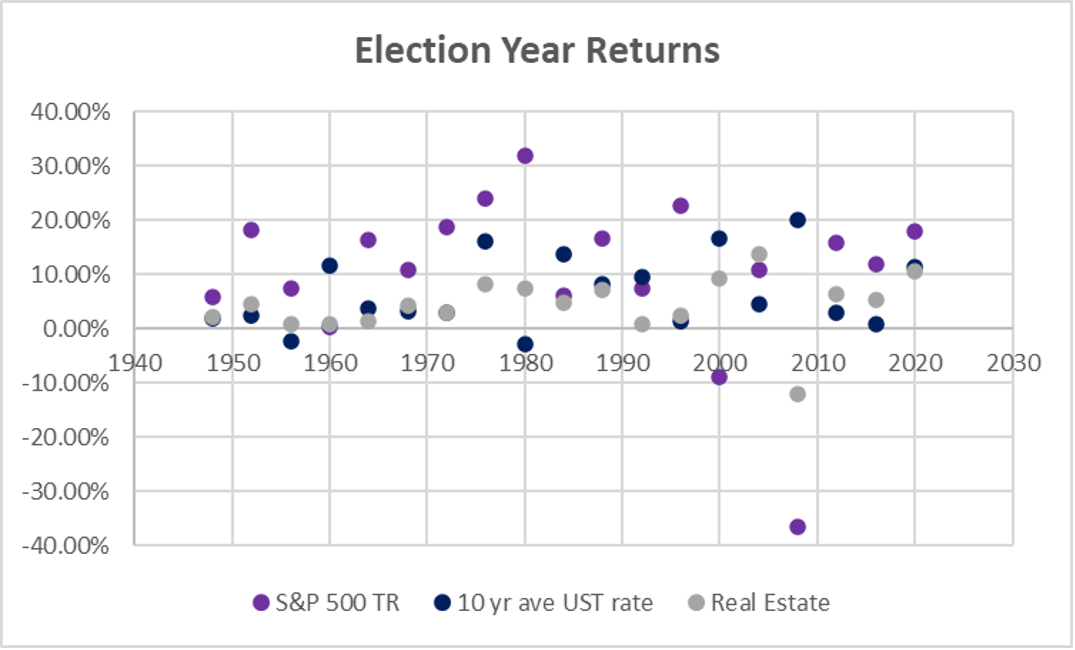

So let’s talk about everyone’s favorite topic: politics. A 2020 U.S. presidential rematch seems the most likely situation at this stage of the race. However, many unanswered questions remain in the months ahead, with implications for markets at every turn.

During U.S. presidential election years, Q1 tends to be pretty volatile as voters are unsure who will win primaries and be the presumptive nominee for their party. However, this year might be different with support for the incumbent and challenger largely crystalized (note that Donald Trump’s legal challenges could change this). The second and third quarters tend to be good-performing stock market periods historically, with an average monthly return of nearly 1%. For the five weeks from the beginning of Q4 until election day, the markets tend to get a bit jittery. Once the winner is pronounced, the market tends to be pacified by the certainty of who will be leading the country for the next four years.

In the 19 U.S. presidential elections post the Second World War, investors have seen positive stock market returns in all but two calendar years (during the 2000 dot com bubble and the 2008 Great Financial Crisis). Similarly, 10-year treasuries returned positively all but two years and real estate returned positively 18 of 19 times according to NYU Stern School of Business:

Source: NYU Stern School of Business (https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html)

Whether you are excited about this election year or decidedly not excited, what is exciting is a historical 10.4% return on S&P 500 stocks, 6.6% return on 10-year treasuries, and 4.2% return on real estate. While past performance is no indication of future results, there is reason to believe that 2024 can provide positive returns to patient investors who stay the course through a U.S. presidential election year.

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.