More than ten years after the initial attempt by the Winklevoss twins to establish the first spot bitcoin ETF, the industry has finally adopted. In total, 11 different bitcoin ETFs began trading on January 11th, including notable issuers VanEck, BlackRock, Fidelity, and ARK.

Bitcoin is the world’s largest cryptocurrency with roughly half of the $1.7 trillion market capitalization. Created in 2008, the purpose of bitcoin was to be a decentralized currency that could not be manipulated by central banks’ monetary policies and eliminated the need for financial intermediaries like banks and payment processors. Bitcoin’s open-source information allows users to validate and verify transactions, promoting transparency and safety with all eyes on the blockchain.

Bitcoin interest among institutional investors has increased over the years. Hedge funds, asset management firms, and endowments have become increasingly interested in its prospects, but many have stayed on the sideline awaiting more adoption. The new ETFs might provide that permission structure to get invested. Enthusiasts point to several features and benefits of bitcoin, mainly:

- Limited supply: Maximum supply of 21 million. This scarcity means that the price has the potential for volatility as adoption increases.

- Increasing adoption: Bitcoin has been gaining traction in terms of the number of merchants that accept it as payment. According to Deloitte, over 2,300 U.S. businesses accepted bitcoin in 2022, including Microsoft, Home Depot, and Virgin Airlines. In 2021, El Salvador made headlines by declaring Bitcoin as legal tender. As the first country to do so, El Salvador serves as a good macro case study for bitcoin as legal tender.

- Potential inflation hedge: Monetary stimulus is currently eroding purchasing power globally and bitcoin might outperform as it’s not subject to the same inflationary manipulation as traditional currencies.

- Diversification benefits: Bitcoin has historically been an uncorrelated asset.

- Divisible and transparent.

Critics of bitcoins argue that it is not actually a currency, it is more of a commodity. In 2015, the Commodity Futures Trading Commission determined that virtual currencies are commodities under the Commodity Exchange Act (CEA). There also has been back and forth with the Securities and Exchange Commission (SEC) about whether bitcoin and other cryptocurrencies are securities and should be regulated as securities instead of commodities. Regardless, it has not been treated as or acted much like a currency.

Currencies are typically standard for a country or region (bitcoin is not the standard in most countries except maybe El Salvador). While bitcoin is being accepted more and more as payment, it is not the primary means of transaction, but it does meet what the St. Louis Fed determines are the primary characteristics of currency: Durability, Portability, Divisibility, Uniformity, and Limited Supply. The other challenge that bitcoin faces is that it has an extremely volatile conversion price when compared to the traditional fiat currencies, making the pricing of transactions very difficult.

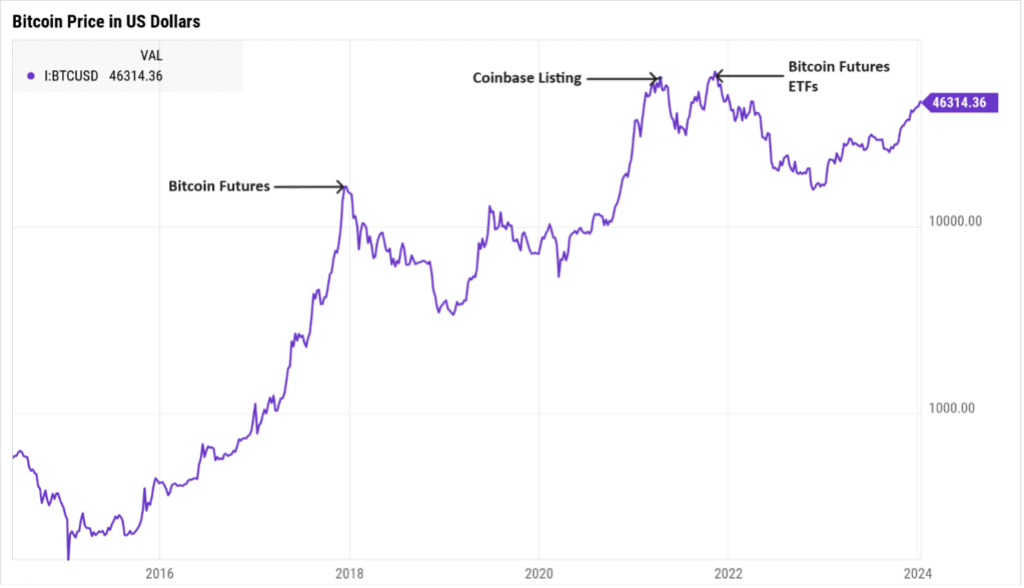

While the launching of these new ETFs goes far to legitimizing the merits of investment in bitcoin, we do not anticipate making an allocation to our portfolios currently for two main reasons. First, the low correlation argument tends to go away when accessing capital markets, so the release of these new ETFs could tighten correlations moving forward. Second, the performance in bitcoin over the last eight years or so has peaked around the launch of a new product or influential company and the price of bitcoin has immediately retreated in the past.

Source: YCharts

From the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.