The Year That Was Not

2023 proved to be another year when the consensus views were not correct. A few of these views that turned out non prescient were that inflation would remain elevated in mid-single digits or higher, higher interest rates would crush housing prices, consumer spending would collapse, and oil prices would continue to rise. In the next few weeks, a consensus on topics such as earnings growth, inflation expectations, and other key financial market factors will inevitably come out. Since we are not in the prediction business, we will listen to the punditry but with a healthy dose of skepticism.

What Went Right?

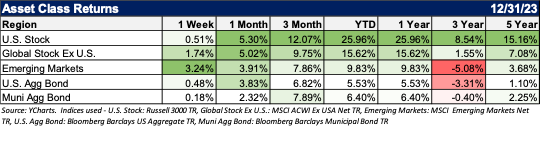

Bonds avoided a fate that they have never seen before: three calendar years of negative returns for the Bloomberg U.S. Aggregate Index (Agg). Domestic and International Equities returned significant positive returns. Alternatives continued to deliver, with positive contribution from hedged equity, market neutral and real estate securities, and negative contribution from commodities.

What Could Go Wrong?

Here’s the rub. When everything is moving up in lockstep, correlations become tight, and markets can retreat just the same. We don’t think that this will necessarily happen in 2024 because of the backdrop for fixed income. Maybe markets are a bit over their skis with the snap recovery of the bond market in the final months of 2023, but the coupon payments could offset market expectations the rate hikes might come fast and furious. Equities are in more perilous territory as valuations have quickly gotten rich. Earnings will need to deliver to maintain these high share prices and rich valuations.

Any Lessons Learned?

Many. First, the U.S. economy is much more resilient than many believed. Employment ended 2023 strong, inflation was tamped down, GDP growth is strong, and the elevated rates could not topple the residential housing market, the new or used auto market or the debt service ratio for an average American.

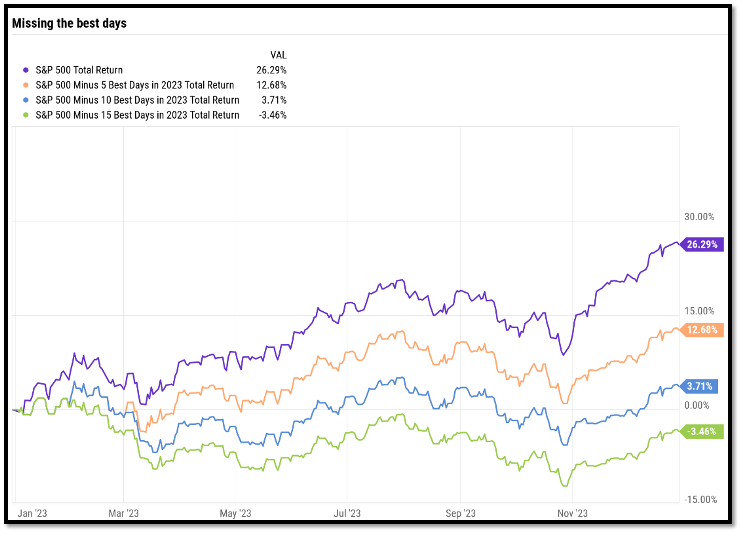

Second, there is nothing wrong with a participation trophy. While the “Magnificnet 7” drove equity returns, broad market exposure and participation drove performance yet again. It is difficult to figure out on a year in year out basis which stocks will lead. Instead of trying to figure out which stocks will outperform, using diversified portfolios like Mutual Funds, ETFs, and Direct Indexing, investors were rewarded for participating in a handful of companies driving market returns.

Source: YCharts. Data as of December 29, 2023

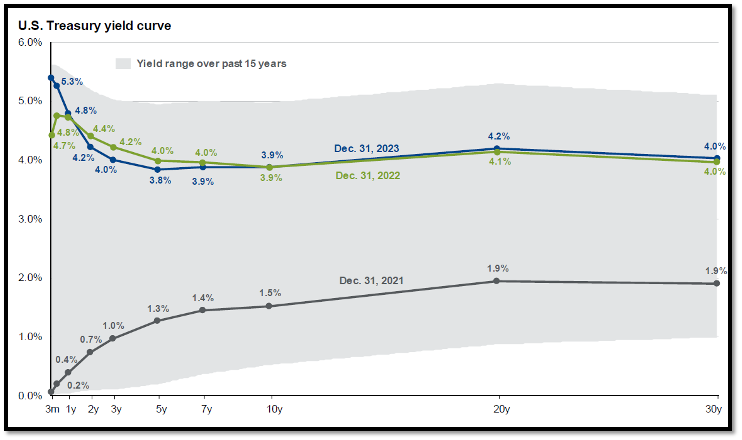

Last, Bond investing is back. The yield curve is steepening (normalizing). We prefer high qualty bonds when credit spreads are tight, but adding duration to a portfolio is finally providing what bond investors should want: enhanced diversification AND enhanced returns. The current interest rate environment should allow for a yield “cushion” should interest rates get erratic and the potential for outsized returns, if and when the Fed decides to start cutting rates.

Source: Factset, Federal Reserve, JP Morgan Asset Management. US Data are as of December 31, 2023.

New Years Resolution?

The more things change, the more they stay the same. Instead of making a promise that you might not keep, let’s reveal the most obvious theme for 2024. The dominant narrative will likely be when and how the Federal Reserve will start cutting interest rates. There remains a large gap between the Fed projects and market expectations. One is likely to disappoint. It should be noted that the market prices their expectations daily and that the Fed only presents quarterly, so there is almost always a natural divergence. There is a real spread between what the market expects and what the Fed has stated.

Source: Bloomberg, Factset, Federal Reserve, JP Morgan Asset Management

Market expectations are based off of USD Overnight Index Swaps. “Long-run projections are the rates of growth, unemployment, and inflation to which a policymaker expects the economy to converge for the next five to six years in absence of further shocks and under appropriate monetary policy. Forecasts are not a reliable indicator of future performance. Forecasts, projections, and other forward-looking statements are based upon current beliefs and expectations. They are for illustrative purposes only and serve as an indication of what might occur. Given the inherent uncertainties and risks associated with forecasts, projections or other forward-looking statements, actual events, results, or performance may differ materially from those reflected or contemplated. U.S. Data are as of December 31, 2023.

Happy New Year from the Investments Desk at Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.