“Always and never are two words that you should always remember never to use.”

~Wendell Johnson

Whew, That Was Close

A short-term spending bill may help avoid a U.S. government shutdown at the 11th hour, but that was just the beginning of the end of Kevin McCarthy’s term as speaker of the House of Representatives. This means that in six weeks, when the continuing resolution to fund the government expires, there is a great deal of uncertainty about who and how Congress can get past its current impasse. The stock markets and bond markets have not reacted favorably to this short-term uncertainty. However, the silver lining here is that even if it doesn’t, shutdowns rarely matter much to the economy or markets. There have been 21 government shutdowns in U.S. history, with the average term of just eight days.

Should the government shut down, it is important to have some context. Essential government functions would continue to operate during a shutdown. Non-essential federal workers would be furloughed, and essential workers would receive IOUs instead of payments. This would impact roughly three million Americans. Importantly, the number of people working in federal jobs as a percentage of total workers is the lowest on record, suggesting the impact to the economy would be minimal. Government spending is roughly 17% of the $26.5 trillion US economy, but only roughly 3% is “non-essential” spending, so relatively small. The U.S. equity market, as represented by the S&P 500 Index, posted positive returns over 12 of the 21 government shutdowns.

Markets

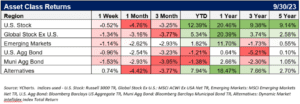

Listen, the fears are real, with the S&P 500 ending September down -5%, with four straight weeks of losses, but is still up nearly +12% year to date. We believe this reflects investors’ fears over the

Subscribe Past Issues Translate

Federal Reserve’s message of higher-for-longer interest rates, surging crude oil prices, and that looming threat of a government shutdown. The bond market also suffered, with the benchmark 10-

year Treasury yield rising 50 basis points to 4.59%, the highest level in 16 years.

There was some good news during the week, specifically, the Fed’s favorite inflation measure, the monthly personal consumption expenditures price index excluding food and energy (core PCE), increased just 0.1%. If inflation continues its recent trend, some out-of-favor investment areas might become attractive. During the last three months, long dated treasuries, dividend-paying stocks, small caps, and gold have all experienced meaningful declines.

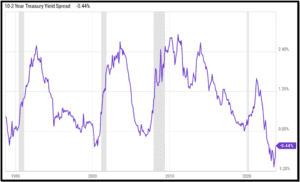

On another positive note, the 10-year U.S. Treasury Yield Minus 2-year U.S. Treasury Yield spread has narrowed to 44 basis points from more than 100 basis points at two occurrences earlier in 023. This metric is often cited as predictive of a recession, so seeing improvement here might help with some investors’ fears.

Central Banks & Monetary Policy Still Dominate The Markets

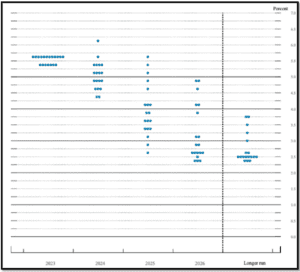

It seems that many developed central banks are sending the same message: higher for longer. Treasury yields on the short end, such as the 6-month T-bill yield, were relatively flat on the assumption that the Fed will probably not need to hike rates again. But the view that rates will be higher for longer has caused Treasury yields on the longer end of the yield curve to rise significantly. The three-, five-, and10-year U.S. Treasury yields rose to their highest levels since 2007 last week and the 30-year U.S. Treasury yield rose to its highest level since 2011.

What is “restrictive” monetary policy? Define “longer”? These are all ambiguous words that are being given an enormous amount of importance, along with the Fed’s Dot Plot. We know that at times that has been wildly inaccurate in predictions of both size and direction before, but it does seem that we are near the peak. This will have a material impact on asset values including bonds, stocks, and real estate.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.