“The investor’s chief problem—and his worst enemy—is likely to be himself. In the end,

how your investments behave is much less important than how you behave.”

-Benjamin Graham

Monetary Policy Remains The Focus

According to the Federal Reserve Bank of Kansas City, the annual “Economic Policy Symposium in Jackson Hole, Wyoming, is one of the longest-standing central banking conferences in the

world. The event brings together economists, financial market participants, academics, U.S. government representatives, and news media to discuss long-term policy issues of mutual concern.”

At the conclusion of the meeting, Chairman Powell reaffirmed a data-dependent approach and said that policymakers at upcoming meetings would “proceed carefully” while assessing incoming economic data. Weaker economic news seems like good news lately, so a weaker-than-forecast jobs number would likely buoy equity markets. It is expected that the Federal Reserve will either hold rates steady at its next announcement on September 20th or raise rates upwards of another 25bps. The movement of monetary policy for the last 15 years or so has had a huge impact on asset prices and investors are hoping that a few factors provide the pause.

1. Jobs: The preliminary monthly Job Openings and Labor Turnover Survey (JOLTS) report for July showed a steady decline for the last 4 months. These declines seem to say that the glut of available jobs is shrinking and additional slack in the labor market could tame some of the wage-push inflation. While the Bureau of Labor Statistics estimated the U.S. added 187,000 jobs in August (above expectations), it is well below the average of 271,000 for the trailing twelve months. Importantly for Fed forecasts and future commentary, the prior month job creation revisions were revised downward again, something that has happened for several months in a row as well.

2. Inflation: Similarly, the inflation data suggested cooling price trends: the PCE Index, excluding Food and Energy, declined to 3.7% in 2Q23 from 4.9% in 1Q23. This was the first reading below 4%, since Q1 2021 and well below the peak of 6.0% in Q2 2021. There is at least one Fed official who agrees with our dovish take on recent inflation trends. The Federal Reserve Bank of Atlanta President Bostic said, “Excluding housing costs, which have eased but flow through to official inflation gauges with a lag, 12-month core inflation using the consumer price index was 2.6% in July. Given the lagging nature of rental prices in the calculation of [official inflation gauges], underlying inflation may well be close to our target already.”

3. Consumer: The Conference Board Confidence Index declined to 106.1 from a downwardly revised 114.0 in July. Perhaps households and businesses are starting to take a more measured approach to spending, which is a possible trend the Federal Reserve would certainly welcome.

Investment Themes

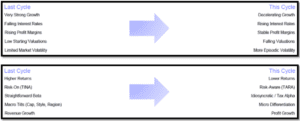

Going forward, we expect the Fed to end its rate hiking cycle and to reverse course in the first half of 2024. This can be hard to predict, and there is still a significant risk the Fed may hold steady for longer. Further disinflation and labor market rebalancing, rather than a desire for policy normalization, will likely inform the rate cutting timeline.

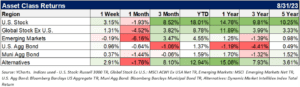

We believe that equities are likely to be resilient over the long-term, though volatility may persist in the near-term. Still, demand may moderate from historically high levels as other asset classes compete. We have already seen that a handful of names are driving market returns, and we do anticipate this will broaden out a bit further, but we want to picky about our exposures.

We prefer higher quality stocks and bonds in the current environment and are balancing the high short-term rate bonds with some long-term bonds to avoid reinvestment risk in the coming quarters.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.