“The stock market is designed to transfer money from the active to the patient.”

-Warren Buffet

It’s Getting Hot In Here…

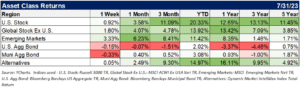

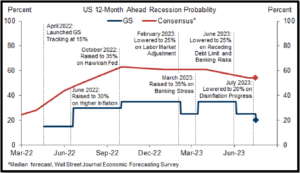

The stock market continued to move higher, fueled by economic data that clearly contradicted the doomsday narrative that was promoted by the inflation and recession fear mongers. The Fed still raised interest rates by another 25 basis points in July, but the market yawned, suggesting a new investor consensus that the Fed hiking cycle is in its final stages. On July 19th, Goldman Sachs economists suggested the chance of a recession in the next 12 months is down to 20%. While this is well below consensus figures, the street is also reducing the chances of recession.

A strong Gross Domestic Product (GDP) report last Thursday showed that the economic recovery gained momentum recently as strong consumer spending and business investment helped keep a

GDP adjusted for inflation, rose at a healthy 2.4% clip in the second quarter, up from 2% in the first three months of the year, and far stronger than forecasters expected a few months ago. While there has been a great deal of uncertainty in the economy and markets, we have been sanguine about the economic downturn. The FED might be steering us well into a soft landing or a weak recession at worst.

How Does This Impact Investors & What Should Worry Us?

- We are not unconcerned about the economy or the markets.

Things are both never as good and never as bad as they seem. We are grateful for what the markets have afforded us for the first seven months of the year (as it is a lot more fun than this time last year), but there is still a small chance of an economic slowdown or significant market correction. - Fixed income markets are volatile as the macro-outlook is still unclear.

We at JSW have stated that going into this year, fixed income was the most attractive it has been in over a decade, when rates were low for a very long time. While we still believe that fixed income can provide great support to a portfolio in the dampening of volatility and income support, we are looking to create a barbell in portfolios to take advantage of the high short-term interest rates and protect the class from reinvestment risk with longer duration, high-quality strategies. - Growth for the latter half of the year could be much softer than the first half. This is a given. The surprises have been nice, but they are coming on the heels of lower expectations. The expectation that the markets could continue at this trajectory is not the base case.

- Credit card debt reached a new record high at a difficult time when credit card rates spiked. This is not a dire concern, but something we are keeping our eyes on. The consumer has been healthy and flush with cash from the stimulus over the last few years (as measured by money market levels) and riding a wave of low fixed-rate debt. However, as the cost of debt rises on credit card balances, it can squeeze the cash flow and spending patterns of consumers. Remember, consumption is nearly 70% of GDP, a HUGE driver of the economy.

- A Fed pause is increasingly likely in September, supporting the case for staying fully invested.

What Is An Investor To DO?

Although volatility is an inevitable part of your investing journey, financial advisors and their investment teams can help you keep volatility in perspective and keep your goals within reach. Clients that felt the pain of 2022 have been well rewarded by 2023. Staying the course really comes down to your risk tolerance or in other words, your appetite for risk and your ability to take risk, based on your goals and time horizon. If you are losing sleep at night worrying about what’s to come, talk to your advisor who can help put in perspective how your portfolios are aligned with your risk tolerance and overall plan.

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.