“It’s the economy, stupid.”

~James Carville

The Good News And The Bad News

Jobs are being added in record numbers. June’s (unadjusted) job growth number marked the biggest monthly gain since last July and was more than double the consensus forecast. Rather than celebrating that sign of economic resilience, investors instead focused on the increased likelihood of the Fed raising interest rates at this month’s meeting in response to that data.

The Fed has a dual mandate to control inflation and manage unemployment in its interest rate decisions. As we know, inflation has been a challenge for over a year now. The overall price level is higher than it was pre-pandemic because of a combination of the $814 billion dollars in stimulus payments from the government to households and the supply chain disruptions. More money in consumers’ pockets, combined with the constrained supply of goods and services, translated to higher prices. While the supply chains have healed somewhat, with the world economy reopening, the Fed raised rates to put a damper on the pricing increases. According to the Bureau of Labor Statistics, inflation had fallen 11 months in a row through May (as of this commentary, we do not know the June data). It is unclear how much increasing the rates by another 25 or 50 basis points would help in the continued fight against inflation; the markets are anticipating another 25bp hike after the next Fed meeting.

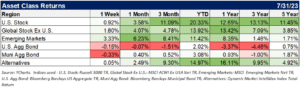

The fears of tightening monetary policy spiked bond yields and added a great deal of volatility into the fixed income markets. However, it did not cool off the rally that the equity markets have been experiencing for some time now.

The S&P 500 has climbed into bull market territory after rallying more than 20% off the October 2022 lows. It took over 8 months for the S&P 500 to surpass the 20% threshold off the October Our concern remains that a handful of stocks and sectors are supporting the equity market rally.

Not Halitosis, Just Bad Breadth

In last month’s commentary, we spoke to the narrow market performance driven by a handful of mega-cap higher quality names, and how that might not be a signal that the markets and economy overall are on very good footing. While the stock market has continued upward, and some of these household names (think Apple, Microsoft, Tesla, etc.) continue to dominate the performance of the overall market, there was an uptick in Small and Mid-Cap performance in June. While this is a welcome addition to diversified portfolios, there remains some challenges for these smaller companies.

- In terms of earnings per share, 45.5% of Russell 2000 companies (Small Cap Index) were unprofitable as of Q1 2023, according to FactSet.

- As many of these companies are unprofitable, they rely on financing to continue operations. The higher interest rate and tighter credit environment only exacerbate the challenge of becoming profitable.

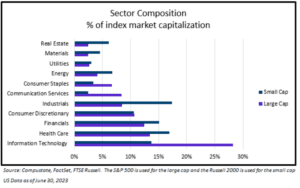

- The composition of the Russell 2000 is vastly different than the S&P 500. The top 3 performing sectors of the S&P 500year-to-date are Technology, Communication Services, and Consumer Cyclicals(each above +30% for the year). Combined, those sectors are 47.4% of the S&P 500 and only 26.8% of the Russell 2000.

If the economy is slowing, we believe that smaller companies will struggle more than larger companies. When the economy turns, small caps tend to lead. We are not of the opinion that we have avoided a recession or that the economy is back in expansion mode, but it does appear that the Fed is doing a very good job of orchestrating the fabled “soft landing.”

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.