Have you ever been to the pharmacy to buy something as small as razors and noticed that razors in the pink packages next to all the fruity-scented shaving cream cost a bit more than the same ones in the blue and black packages? What about deodorant? Does the Women’s Degree Anti-Perspirant cost at least a dollar more than the same pack for men? On average, women’s products cost 7% more than similar products marketed toward men. These same products can cost up to 50% more overall1. This consumer phenomenon is called “The Pink Tax”.

“The Pink Tax” is the use of gender-specific pricing where goods and services marketed to women are marked up higher than the equivalent products and services for men2. Although this term was coined in 1994 when California’s Assembly Office of Research found that 64% of stores charged more to dry clean a woman’s blouse than a man’s button-up3, the pink tax can be dated back to the late nineteenth – early twentieth centuries when companies began to realize they could capitalize on feminine hygiene products- and much more.

Purchasing Power of Women:

Today, women influence or control over 85% of consumer spending in the U.S. and over $31.8 Trillion in spending worldwide. Women currently control over $10 Trillion (33%) of total household assets in the U.S. while making 79 cents for every dollar earned by a man5. However, we can expect a shift in the upcoming years as women stand to inherit the wealth of their late spouses, approximately $30 trillion by the end of the decade6.

Other Statistics:

- 80% of women say they are the primary grocery shopper, and 71% say they do both the shopping and prepare the meals.

- Women spend an average of $44.43 per (grocery) shopping trip, compared to men ($34.81).

- Since 1982, women (22.43MM) have earned 4.35 million more bachelor’s degrees than men (18.08MM).

- 17% of women shop online daily.

“By many estimates, the pink tax costs women an average of $1,300 annually. If the same amount were invested into a retirement fund each year, that would amount to about $16,000 over 10 years (assuming an annual return of 5%) and nearly $160,000 over a 40-year work life”, (Jeanne Sun, JP Morgan) 7.

Who Benefits?

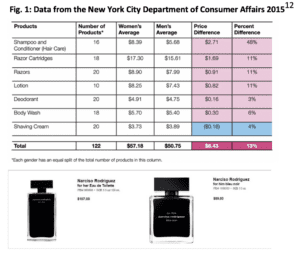

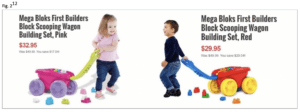

Judit Arenas, APCO Worldwide, stated “The pink tax is important for female consumers because it actually spreads across the entire chain”8. Not only are there cost discrepancies among women’s products (Fig. 1), but toys for girls cost up to 13% more than those for boys (Fig .2). Ex: a retailer charges $14.99 for a blue boy’s helmet and $27.99 for an identical girl’s helmet in pink9.

In addition, services such as dry cleaning, haircuts, auto maintenance, and more are priced higher for women than they are for men. So, who is benefiting most from this female-targeting, inimical margin?

While the “Tampon Tax” is a real tax many states impose on menstrual hygiene products10, the pink tax is not an actual tax placed by the government. The only ones benefiting from the price markup are the companies selling women’s products at a higher cost2. That being said, there is a real pink tax in the form of import tariffs. Women’s clothing imports are taxed 3.2% higher than men’s clothing imports4. While this is an unfortunate statistic that applies to apparel, it does not explain why manufacturers would charge more for women’s products and services overall.

What Has Changed?

In 1996, the Governor of California implemented the Gender Tax Repeal Act of 1995, which required merchants to charge men and women the same for services (dry cleaning, clothing alterations, haircuts, car repairs, and other services) if those services require the same amount of time, skill, and resources. The Mayor of New York followed suit and in 1998, signed a bill to prevent gender-based pricing discrimination of drycleaners and hair stylists.2

In 2016, Representative Jackie Speier, a supporter of the Gender Tax Repeal Act, introduced the Pink Tax Repeal Act at the 114th congressional meeting4. This would make it illegal to charge men and women differently for similar products and services on a national level. Its purpose is “to prohibit the pricing of consumer products and services that are substantially similar if such products or services are priced differently based on the gender of the individuals whose use of the products are intended or marketed or for whom the services are performed or offered. Companies violating the law would be considered in violation of the Federal Trade Commission’s unfair or deceptive acts or practices rules affecting interstate commerce.” 2 The bill has been introduced several times but still has not passed. The failure to pass the bill is consequent of the interests of large corporations outweighing consumer rights and the considerable interpretation of what may fall under “substantially similar”.

Education Goes a Long Way

While $1,300 annually may seem like an insignificant fee, when women are already being paid less on average than men and only owning 32 cents for every dollar owned by men, women will have less invested for retirement. So, what can you do? Directly, use gender-neutral products and avoid purchasing female products with an obvious and sizable markup.

Ultimately, use the available research to stay informed. Utilize resources that invest in women and meet the needs of female clients and consumers. Talk to your financial advisor about strategies to maximize retirement income and minimize investment taxes.

Lastly, according to Bank Rate, “you can help eliminate the Pink Tax once and for all by contacting your local representative13 and speaking out against discriminatory pricing”.9

List of Representatives that cosponsor The Pink Tax Repeal Act11: Jackie Speier, Lucille Roybal-Allard, Joyce Beatty, Suzanne Bonamici, Julia Brownley, Cheri Bustos, André Carson, Kathy Castor, Judy Chu, David Cicilline, Bonnie Watson Coleman, Madeleine Dean, Debbie Dingell, Dwight Evans, Brian Fitzpatrick, Lois Frankel, Jesus Garcia, Raúl M. Grijalva, Josh Harder, Alcee L. Hastings, Jahana Hayes, Pramila Jayapal, Henry C. “Hank” Johnson, Donald S. Beyer Jr., Robin Kelly, Dan Kildee, Brenda L. Lawrence, Al Lawson, Barbara Lee, Sheila Jackson Lee, Ted W. Lieu, Alan Lowenthal, Carolyn B. Maloney, James P. McGovern, Grace Meng, Gwen Moore, Eleanor Holmes Norton, Alexandria Ocasio-Cortez, Ilhan Omar, Mark Pocan, Jamie Raskin, Tom Reed, Tim Ryan, Debbie Wasserman Schultz, Albio Sires, Darren Soto, Dina Titus, Rashida Tlaib, and Nydia M. Velázquez.

________________________________________________________________________

1https://www.forbes.com/sites/lawrencelight/2022/02/12/theres-a-pink-tax-on-women/?sh=3a2524e07318

2https://www.investopedia.com/pink-tax-5095458

3http://www.leginfo.ca.gov/pub/15-16/bill/sen/sb_08510900/sb_899_cfa _20160625_194332 _asm_comm.html

4https://soar.suny.edu/bitstream/handle/20.500.12648/6708/honors/221/fulltext%20%281%29.pdf?sequence=1

5https://www.cnbc.com/2022/05/03/money-decisions-by-women-will-shape-the-future-for-the-united-states.html

6https://www.catalyst.org/research/buying-power/

7https://www.chase.com/personal/investments/learning-and-insights/article/the-problematic-pink-tax

8https://www.businessinsider.com/personal-finance/pink-tax

9https://www.bankrate.com/finance/credit-cards/pink-tax-how-women-pay-more/#section3

10https://www.globalcitizen.org/en/content/tampon-tax-explained-definition-facts-statistics/

11https://speier.house.gov/2021/6/speier-reintroduces-pink-tax-repeal-act-to-end-gender-based-pricing-discrimination

12https://www.jec.senate.gov/public/

13https://www.house.gov/representatives/find-your-representative

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC”). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.